Nasdaq Trading Strategies: QQQQ, FRPT, QID

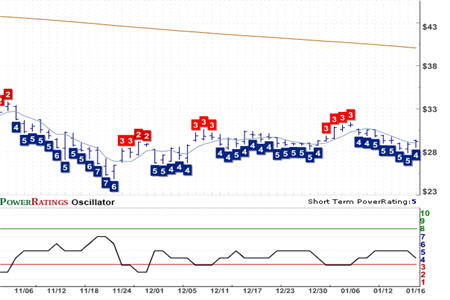

Going into trading on Tuesday, we had a Nasdaq that was climbing into overbought territory. As of the Friday close, the Nasdaq Composite had a 2-period RSI of more than 60 (the Nasdaq 100, incidentally, was even higher). Consider this chart of the PowerShares Nasdaq Unit Trust ETF, QQQQ

(

QQQQ |

Quote |

Chart |

News |

PowerRating).

>

>

This means that the selling we see in the Nasdaq in the first few hours of trading on Tuesday should be of little surprise.

Right now, there are precious few stocks in any market that have earned the sort of high Short Term PowerRatings that alert us to buying opportunities in stocks. In fact, within our Top 25 PowerRatings list, there is only one Nasdaq stock with a Short Term PowerRating of 8 or better: Force Protection Inc.

(

FRPT |

Quote |

Chart |

News |

PowerRating), which has a 2-period RSI of 40.00 as of the Friday close and a Short Term PowerRating of 8. This stock is pulling back nicely on Tuesday morning and could earn a PowerRatings upgrade.

>

>

Remember that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days. This is based on our analysis of millions of simulated stock trades between 1995 and 2007.

How long are these conditions of high Short Term PowerRating scarcity in the Nasdaq likely to last? Taking a closer look at the Nasdaq through the lens of some of the exchange-traded funds based on that market, we can say two things:

1. Current selling in the Nasdaq is likely to create oversold conditions that could earn Short Term PowerRatings upgrades for those few Nasdaq stocks trading above their 200-day moving averages. While these stocks are not especially numerous, they will represent some of the superior trading opportunities in stocks in the Nasdaq and by their high Short Term PowerRatings we shall know them.

2. A rally that sends the Nasdaq into overbought territory – at which point we will begin seeing high Short Term PowerRatings on inverse/short ETFs like the ProShares Ultra Short QQQ ETF, QID

(

QID |

Quote |

Chart |

News |

PowerRating) – is at least a few days away.

>

>

Because of this, it is likely too late to short (the ideal time to have shorted the Nasdaq was at the beginning of the year when the market was overbought) and still too early to buy with any aggression. The resolution of today’s sell-off – or at least the sell-off we are seeing in the early hours on Tuesday – should provide significant clues for our next step.

Want to take your trading to another level? Click here to find out more about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

David Penn is Editor in Chief at TradingMarkets.com.