Oil at 70? Has The Trend Changed?

“The price of oil could drop to between $70-80 a barrel if the U.S. Dollar strengthens and concerns over Iran are reduced,” Chakib Khelil, president of the Organization of Petroleum Exporting Countries (OPEC), said Saturday (as reported by Channel NewsAsia).

Wow, positive news from a reputable source, finally coming out about oil prices, which will translate quickly to lower gasoline prices at the pump.

Oil has been dropping rapidly since posting an all time high on July 11th, touching above 147. It has fallen nearly 16% or $23.00 from the high. A change from a bull to a bear market is generally considered to have occurred after a 20% pull back from the highs.

As you can see, we don’t have far to go for this “rule of thumb” to activate which will create a media buzz that may further depress prices, as longer term investors sell, based on the “bear market” media proclamations. An attack on 2 major Nigerian pipelines operated by Royal Dutch Shell by a militant group caused a spike up in prices this morning. Prices are now retreating back as of this writing. This incident is a classic example of how sensitive oil prices remain to supply disruptions and even rumors of potential disruptions in the short term.

Traders with a bearish bias can use these news generated spikes to better position short positions, if this price jumpiness continues. The macro picture of fuel demand decreasing in the United States appears to be the true prime mover in this market. Another important fact to note is that the CFTC released data on Friday indicating that speculative funds were shifting their oil positions to a net short position for the first time in over a year and a half. Investors and traders use the CFTC data to attempt to follow the “smart money” and now it appears that the “smart money” is shifting its bias to short. Price dropped below the 50-day SMA last Monday at 133.58, the 200-day SMA is presently at $107.74.

I believe the e-mini oil contracts are an excellent tool for traders to use who want to capture profits from this potential change in the oil trend. They possess the liquidity, ease of shorting, and access required in this volatile marketplace. Here is a basic primer on these contracts so you can better understand how to get started in this market.

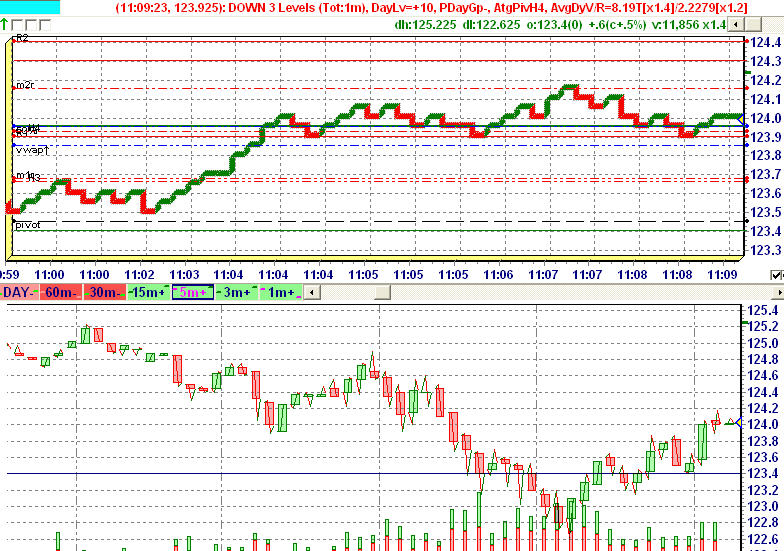

The oil e-mini contracts are traded on the NYMEX and utilize Light Sweet Crude Oil as the underlying commodity. The symbol is QM and it trades basically 24 hours a day, Sunday through Friday with a daily 45 minute break between 5:15 P.M. and 6:00 P.M. eastern time. Trading months include all the months remaining in the year and over the next 5 years. The mini trades in increments of 500 barrels and has a minimum price fluctuation of 2.5 cents/barrel which translates into $12.50 a tick. To hold overnight, $5906 margin is required per contract. However, several brokers allow much lower margins for strictly day trading. Here is a chart example of the QM trading today on a 5 minute timescale:

Whatever your bias in this market, now is a good time to check out oil via the e-minis.

David Goodboy is Vice President of Marketing for a New York City based multi-strategy fund.