One Thousand Paths & 5 PowerRatings Stocks

“Every morning I awake to 1000 different paths to take…” This quote, I believe attributed the indomitable Henry Miller, refers to the myriad of choices we have in our every day lives. No where is this more true than in the daily responsibilities of the short term investor.

Every time you turn on your computer there are literally thousands of choices begging you to take a chance with them. It’s as if the financial media, individual companies, and even the market itself are a huge machine designed to force you to buy and/or sell based on whims or passing feelings. The ability to weed out the majority of these thousands of names and instruments to focus only on those that are most likely to appreciate over the short term is the mark of the successful trader.

There have been literally 100’s of different scanners and screeners, some quite complicated, developed to solve this too many choices issue. Stocks are shaken and baked in a massive variety of ways to locate those special names ready to make a fast move.

As with most things in life, simple is generally superior to complex when it comes to making correct choices for short term investing.

We have developed a simple, quantified, and tested 3 step method for choosing the right path (stock) from the literal thousands of choices. This tactic has been tested on over 8 million transactions and has proven to place the odd of success solidly in your favor. This article will lay out the 3 steps and provide 5 stocks fitting the criteria for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this flies in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

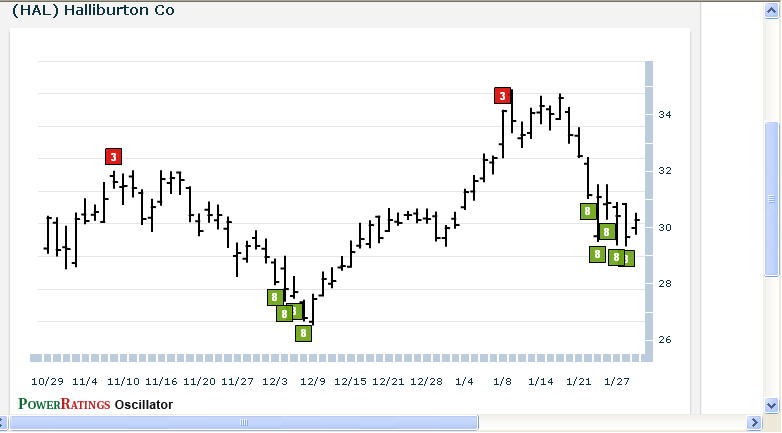

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 5 names primed for short term gains:

^HAL^

^ABD^

^ATU^

^LAMR^

^HSII^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.