Over the next 2 days, here’s the trading pattern I’m expecting to see

Mutual funds will be mailing out some

very good looking statements this month… they sure saw to that fact on

Wednesday. What started as a little bit bumpy soon turned into a sustained ramp

into the closing bells. With the start of September tomorrow and unofficial end

of summer this weekend, what may we expect from here?

ES (+$50 per index point)

S&P 500 recap: the ES opened and traded inside

its bull = bear zone until roughly 11:00am EST. A breakout and subsequent pull

back offered two buy signals near 1210 and one near 1212 before the northbound

train left its station for good.

There were a couple more swing-trade method

signals on a smaller timeframe basis, but overall this was the action today.

Very methodical, if not somewhat surprising to the heights ES reached. Never

mind layers of recent resistance… several of them were run over by mutual

funds painting the tape in a thin volume atmosphere.

ES did stop just 50% retrace of August high to

low swing and clustered DMA values, setting up more congestion in stop levels

for the remainder of this week.

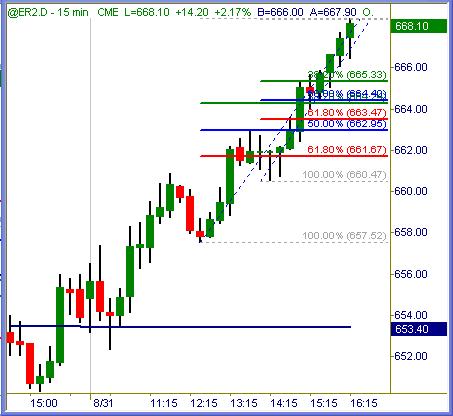

ER (+$100 per index point)

Russell 2000 recap: similar pattern as ES

above… bullish at first, never went bearish confirmed, bullish again near

654.80 and pulled back at least two more times at higher levels. This is the

type of trend-day session where price action stair-steps higher… very bullish

by nature. It plowed thru all manner of recent resistance levels from 660ish

upward, stopping nearly to the tick at 50% retrace of August high to low swing

as well.

ES (+$50 per index point)

S&P 500 has 1217 level as dual congestion of

retracement values. That should offer initial support, followed by 1215 as next

line in the sand. There is no real bearish zone of bias following a straight-up

move like this, except watching overhead congestion on longer-term charts for

potential failure.

As noted earlier, ES is right at key congestion

of layered resistance on daily charts. The last two sessions this week might see

a struggle to resolve itself higher or lower as we head into the long holiday

weekend.

ER (+$100 per index point)

Russell 2000 has layered support thru the 664+

zone, then again near 663 ~ 663.50 zone. Any pull back to these levels are

likely to hold… and a straight drop thru them is probable to continue.

Just like the ES charted above, ER is meshed in

layered resistance right now. Upside continuation may be tough, we’ll see.

{Price levels posted in charts above are

compiled from a number of different measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

Summation

The end-month markup came as expected & predicted, and they got the

party started early today. What is usually a final-hours’ move began around

11:00am EST and ground higher all day. Absolute lack of sellers painted hockey

stick charts right into the close of futures trading.

That said, how much of this may be unwound

tomorrow or the next day? Trading volume is certain to thin mightily as this

week draws to a close. Sessions following trend days like this tend to chop and

flop sideways more often than not.

Preconceived Mistake

I myself will not be trading again until next Tuesday, for better or

worse. This week was very good to me, but had I been a bit more aggressive on

taking all entry signals it would have been phenomenal instead. The past couple

of years, end-August months’ trading have chewed me to little pieces. Last year

a good friend of mine (+$100 profit scalper in mini markets) and excellent

trader vowed we’d take the last two weeks of this August off.

I remembered that conversation and those prior

experiences this year. I brought that fear of the past into the present, and

trading tippy-toe thru a wonderful period of market action cost me significant

missed profits.

Bottom line? Never try to predict future price

action. Markets are designed to surprise us the most when we least expect it!

My next emini post will be Tuesday morning, and

the weekend article will cover something of educational value to all. Trade

carefully thru the balance of this week, and have an excellent holiday weekend.

Viva La Summer!

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.