PowerRatings and the Work of Waiting

Just about every trader I have interviewed as part of our Big Saturday Interview series has offered the opinion that one of the problems with online trading is that, for too many traders, executing trades has all the look and feel of playing a video game.

The problems with this, especially for new traders, are many. But one of the biggest problems – and one that affects veteran traders as well as rookies from time to time, is the temptation to overtrade.

This temptation is all the greater in our electronic, online trading age. A trader, for example, who has to pick up the phone, call a broker and explain in real language that he wants to buy an extremely oversold ETF trading several leagues below its 200-day moving average has far more time to reconsider that trade than a e-trader who, with an all-too-often impulsive push of a button or click of a mouse, can make that trade happen, instantly, without having to say anything to anyone.

I think about this Tuesday morning before the open as I look at a Top 25 PowerRatings roster that has more 7-rated stocks than 9-rated stocks. Compare this list to the list we saw a week ago, when the Top 25 list was equally split between 9- and 10-rated stocks – or the week before that, when the Top 25 PowerRatings roster featured more of our top rated stocks than stocks with any other rating.

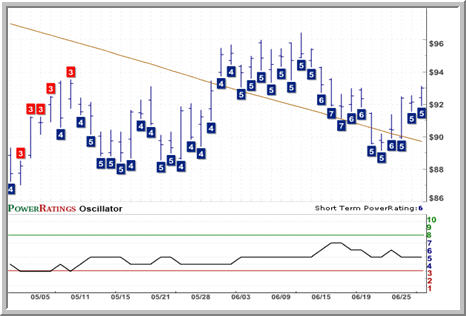

S&P 500 SPDR ETF – SPY: With so little green on this PowerRatings chart, traders may be well advised to wait for better opportunities to buy weakness.

In a recent, to-be-published interview with The Kirk Report founder, Charles Kirk, Larry Connors, founder of TradingMarkets and author of High Probability ETF Trading, noted that as he became more and more experienced, he recognized that risk management was increasingly more important to his trading success than “stock picking” per se. If there were one thing in common with most of the great trader he knew, Larry added, it is that they are “phenomenal risk managers.”

How does this relate to PowerRatings traders and the current market environment? Right now, there simply aren’t very many strong edges for high probability traders. And when that is the case, when there are as many 7-rated stocks as 9-rated stocks in our Top 25 and the SPY is sporting a PowerRating of 5, traders who are serious about making money rather than losing it may be better off waiting for the next correction before making any major moves. Instead of chasing the new potential opportunities that may exist, it is often the more prudent approach to wait until these opportunities are plentiful and the high probability PowerRatings trader can take his or her pick of the best in the bunch.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of more than 14 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.