PowerRatings Chartology: 3 Stocks for Swing Traders

Stocks are off to a strong start on Friday morning following two days of aggressive profit-taking in the markets. An hour after the bell, the Dow, Nasdaq Composite and S&P 500 are all trading more than 2% higher.

The two-day sell-off created significantly oversold conditions across the board, and today’s rally is in large part likely a response to those conditions. Of course, the sell-off itself is a reaction to the rally from the mid-October lows, a rally that created extremely overbought conditions in the first week of November.

The shake-out has left us with a few stocks that are still trading above their 200-day moving averages, stocks that may represent opportunity for swing traders if they provide the right intraday weakness to allow buyers of weakness to climb on board. Three of those stocks are presented here — along with an analysis of their respective PowerRatings charts to show how these stocks have reacted to previous instances of high and low Short Term PowerRatings.

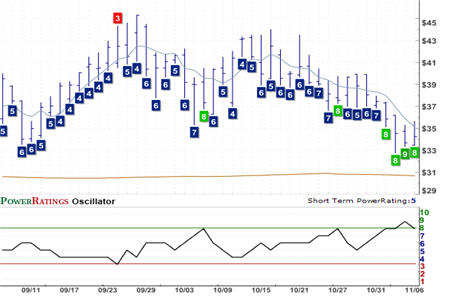

Ultratech Inc.

(

UTEK |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 7.02

What is interesting about the PowerRatings chart for Ultratech Inc. is how the stock developed extremely low Short Term PowerRatings just as it was crossing the 200-day moving average in mid-October. These low ratings — the stock was downgraded to a 1-rating for five consecutive days helped signal to traders that the stock would struggle to make continued upside progress in the near-term. This is one of the ways that I have suggested that traders can use low Short Term PowerRatings to help anticipate potential pullbacks before they happen.

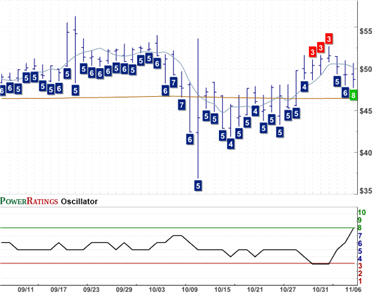

Usana Health Sciences Inc.

(

USNA |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 36.08

The PowerRatings chart for USNA does not have many instances of low Short Term PowerRatings anticipating pullbacks over the past several weeks. But we do see a few instances in which high Short Term PowerRatings of 8 helped alert traders to oversold extremes from which the stock bounced. This was strongly the case in the first half of October and also again, in a more muted fashion, late in the month.

Northwest Natural Gas Company

(

NWN |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 10.74

Last, let’s take a look at NWN.

In some ways, the current pullback in Northwest Natural Gas Company is similar to the previous pullback in Ultratech Inc. NWN just recently rallied above its 200-day moving average and, in doing so, earned Short Term PowerRatings downgrades to 3. Within a matter of days, the stock was pulling back to its 200-day moving average and had earned a PowerRatings upgrade to 8.

All three stocks in today’s report have Short Term PowerRatings of 8. Our research into short term stock price behavior since 1995 indicates that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.