PowerRatings Chartology: 3 Stocks for Swing Traders

Stocks are off to a weak start Friday morning as news of the Senate’s failure to pass the automaker bailout legislation on Thursday has put a cloud over the morning’s trading.

It is also worthwhile to see the early selling on Friday as part of a follow-through from the selling on Thursday. Regardless of the news, those of us who follow Short Term PowerRatings and the overbought/oversold condition of the markets using the 2-period RSI know that stocks began the week very overbought and that what we are seeing is, if nothing else, further unwinding from those overbought conditions.

By the way, would you like to learn how to trade using the 2-period RSI? Click here to read what traders are saying about Larry Connors and Cesar Alvarez’ newest book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

Recent price action has enabled a few stocks with Short Term PowerRatings of at least 8, to pull back to potentially attractive levels. With the selling we are seeing so far on Friday, a number of these stocks should have pulled back even further, making them all the more compelling options for short term traders looking to trade a bounce in stocks over the next few days.

Rohm & Haas Company

(

ROH |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 1.40

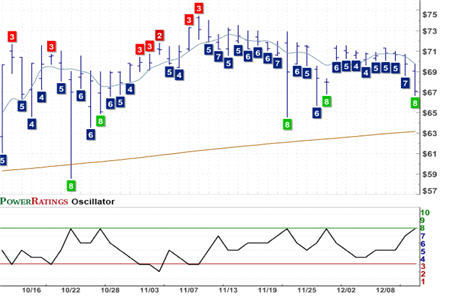

The PowerRatings chart of Rohm & Haas features a number of sharp, short term pullbacks during which the stock’s Short Term PowerRating soared from as low as 5 to 8. Note how the stock responded each time its Short Term PowerRating advanced to an 8.

New Jersey Resources Corporation

(

NJR |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 8. RSI(2): 3.47

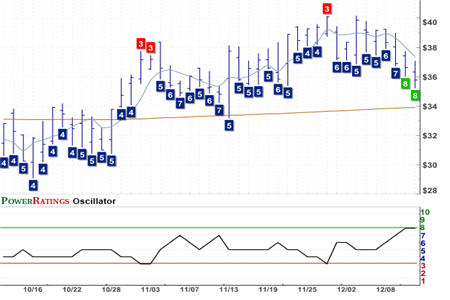

In the PowerRatings chart of New Jersey Resources Corporation, we see another of my favorite ways to read PowerRatings. Here, focus less on the high Short Term PowerRating NJR developed over the past few days and instead notice how the stock responded every time its Short Term PowerRating fell to the “consider avoiding” range of three or less.

Cubist Pharmaceuticals Inc.

(

CBST |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 3.60

Lastly, in the PowerRatings chart of Cubist Pharmaceuticals, we see a bit of both ways to read and use our PowerRatings. First, see how CBST pulled back in the short term every time the stock’s Short Term PowerRatings fell into the “consider avoiding” range of three or less. Second, note how the stock rebounded to higher levels as the pullbacks that followed those low Short Term PowerRatings led to Short Term PowerRatings in the “consider buying” range of 8 or more.

2008 has been a challenging year for traders. But our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.