PowerRatings Chartology: TMP, COGT, FDO

One of the worst job reports in years has helped drive stocks lower in the hour after the open on Friday. As of this writing, the Dow, the Nasdaq Composite and the S&P 500 are all off more than 1%.

I have pointed out in the past that one of the helpful aspects of our Short Term PowerRatings is that when quality stocks with high Short Term PowerRatings are hard to find, it is often a good signal that traders who buy weakness and sell strength should probably be sitting on the sidelines.

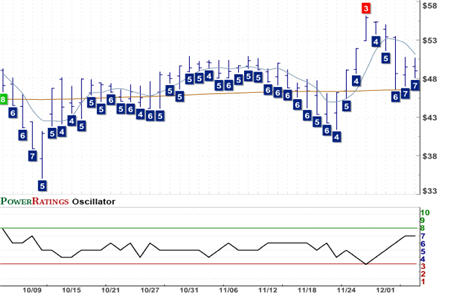

Tompkins Financial Corporation

(

TMP |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 7. RSI(2): 24.28

That can be a difficult message to take, especially after traders have taken in significant gains – as many Short Term PowerRatings traders have over the course of the week. But it is a critical skill to master. Trading without an edge is like swinging at pitches that are out of the strike zone: you’ll hit a few, but your percentage of quality hits will be much lower.

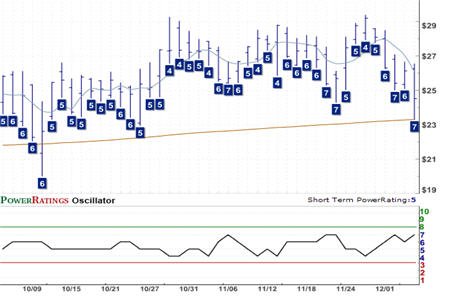

Cogent Inc.

(

COGT |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 6. RSI(2): 33.13

This week in PowerRatings Chartology I have found a few stocks that are trading above their 200-day moving averages and have reasonable, but not overwhelmingly high Short Term PowerRatings. These are stocks that I would suggest be put on a watch list rather than traded immediately. Should any of these stocks pull back further and earn upgrades to their Short Term PowerRatings, then any one could actually become an attractive trading candidate.

Family Dollar Stores Inc.

(

FDO |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 7. RSI(2): 15.96

Again, it bears emphasizing that we are in a significantly “edge-free” market environment right now. Although we came close to getting some significant overbought signals late on Thursday, the sell-off eliminated the vast majority of those. Recall that overbought conditions are extremely precarious in bear markets, as the abundance of sellers means that markets cannot and will not remain overbought for long. That was the case Thursday afternoon and will require both agility and patience on the part of swing traders to be able to step in at the right time before overbought conditions lead to the inevitable breakdown.

Fortunately, our Short Term PowerRatings do a lot of the work for us.

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click here to find out what traders are saying about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

David Penn is Editor in Chief at TradingMarkets.com.