PowerRatings, ETF Trading and Shorts on Sale: MZZ, QID, REW

U.S. index futures were down in the hours leading up to the open on Monday, though off their worst overnight levels.

It should be of little surprise to traders to see stocks sell-off early on Monday. Stocks ended last week exceptionally overbought below the 200-day moving average. Our research indicates that stocks and ETFs that become overbought below the 200-day moving average are those stocks that are most vulnerable to reversal in the short term.

When the opportunity arises to bet against stocks – as it does when overbought extremes are reached and Short Term PowerRatings in stocks and ETFs move lower and lower – these are the stocks and ETFs that we target for potential short sales.

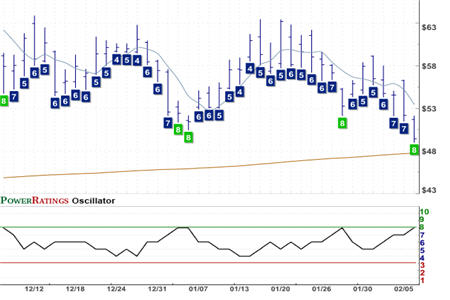

ProShares UltraShort MidCap 400 ETF [NYSE:MZZ] Short Term PowerRating 7. RSI(2): 2.97

If the mechanics of selling stocks and ETFs short is something you are not comfortable with, buying short/inverse exchange-traded funds is an excellent option for short term traders.

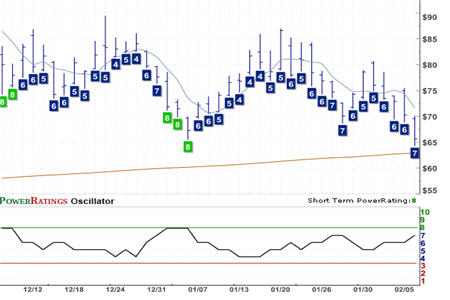

ProShares UltraShort QQQQ ETF [NYSE:QID] Short Term PowerRating 8. RSI(2): 2.40

Two out of the three short ETFs in today’s report have Short Term PowerRatings of 7. Because they are not yet at a level of 8 or higher, I consider these two ETFs to be “watch list specials.” Keep an eye on these ETFs over the next few days, with particular attention paid to any Short Term PowerRating upgrade from 7 to 8 or even 9.

ProShares UltraShort Technology ETF [NYSE:REW] Short Term PowerRating 7. RSI(2): 2.95

Take a close look at the PowerRatings charts of the three ETFs in today’s report. You’ll notice that each time the ETFs PowerRating was upgraded to an 8 or higher, the ETF was higher within five days. With this in mind, let upgrades from 7 to 8 (or better) be your guide when it comes to timing opportunities to buy short ETFs on pullback.

Combined with a strategy of using limit orders below the previous close, trading high Short Term PowerRatings ETFs on PowerRatings upgrades is one of a number of winning ways that short term stock and ETF traders can continue to find profitable opportunities in the markets.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.