PowerRatings Pullback Watch for Short Term Traders: INTC, XOM, WMT

With stocks wildly overbought as the market continues its major counter-trend rally from the March lows, there are precious few quality pullbacks for high probability PowerRatings traders to take advantage of. These pullbacks are even harder to find among the most widely-traded stocks of the Dow 30.

This doesn’t mean, however, that PowerRatings traders shouldn’t be watching the market – including the Dow – for potential opportunities that might be around the corner as soon as profit-taking sets in.

For example, the Dow currently includes four stocks with PowerRatings of 2: Intel Corporation

(

INTC |

Quote |

Chart |

News |

PowerRating), American Express

(

AXP |

Quote |

Chart |

News |

PowerRating), Caterpillar

(

CAT |

Quote |

Chart |

News |

PowerRating) and Dupont

(

DD |

Quote |

Chart |

News |

PowerRating). Our research indicates that stocks with low PowerRatings – and 2 is our next to lowest rating – tend to underperform the average stock in the short term. As such, while we may not encourage selling these stocks short – particularly insofar as they are trading above their 200-day moving averages – we do want to keep an eye on these exceptionally overbought markets because they likely will be among those to sell-off dramatically, when traders begin taking profits on what have been very profitable moves higher.

So far Wednesday morning, Intel remains the strongest of the bunch, while American Express has begun to show some early signs of selling.

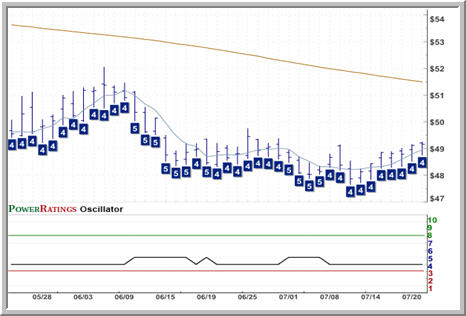

In addition to watching for upside opportunities, there are a few Dow stocks trading below their 200-day moving averages that have become increasingly overbought in recent days. Two of the more prominent stocks in this group include Exxon Mobil

(

XOM |

Quote |

Chart |

News |

PowerRating) and Wal-Mart

(

WMT |

Quote |

Chart |

News |

PowerRating). Traders looking to fade the current market rally may want to consider stocks like these that are exceptionally overbought and trading below their 200-day moving averages.

Exxon, for its part has earned a PowerRating of 3. Moreoever, during its ascent from the July 10th low, the stock has closed with a 2-period RSI of more than 90 for five days in a row heading into Wednesday’s trading.

Meanwhile, Wal-Mart is not quite as overbought as Exxon, but the stock has closed with a 2-period RSI of more than 90 for the past two days going into Wednesday. The stock has closed higher for five out of the past seven trading days.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of more than 14 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.