PowerRatings Pullbacks for Traders: Gold Stocks, Biotechs and More

Stocks continued to sell-off on Tuesday, as traders take profits from the strong March rally.

The selling has helped create oversold conditions in a number of stocks, and it is in these oversold conditions that we are likely to find our next trading opportunities, as these pullbacks contribute to upgrades in PowerRatings, turning 7-rated stocks into 8-rated stocks and nudging 8- and 9-rated stocks higher still.

Click here to learn how to find the best stocks to trade everyday!

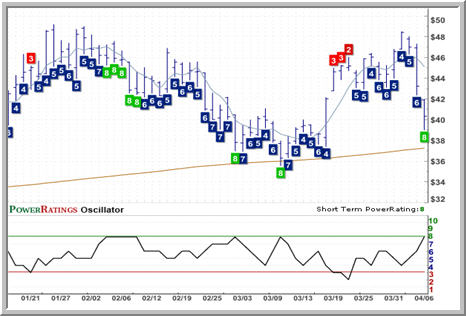

As a side note, and something I pointed out yesterday, gold stocks in particular are being sold aggressively right now. Insofar as these stocks develop high PowerRatings during their declines, these stocks may end up representing some of the better opportunities for traders – as well as for gold bugs and gold investors looking for the lowest prices for gold mining shares. Among those gold stocks still pulling back on Tuesday is Royal Gold

(

RGLD |

Quote |

Chart |

News |

PowerRating), which looks poised to close lower for a fourth consecutive trading session above the 200-day moving average. Other gold stocks and ETFs from yesterday’s column are higher today, but off their intraday highs.

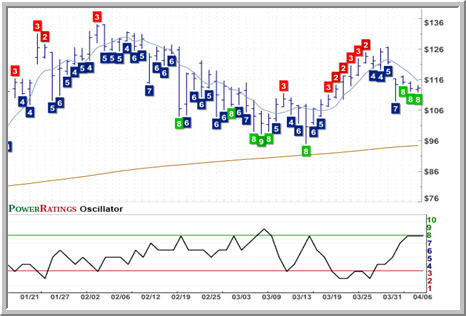

Outside of the world of pullbacks in gold stocks, we are also seeing high PowerRatings in stocks like ITT Educational Services

(

ESI |

Quote |

Chart |

News |

PowerRating). ESI has a Short Term PowerRating of 8, and a 2-period RSI that has fallen from nearly 17 to just north of 4. The stock, which trades above its 200-day moving average, has closed lower for four out of the past five days going into Tuesday’s trading.

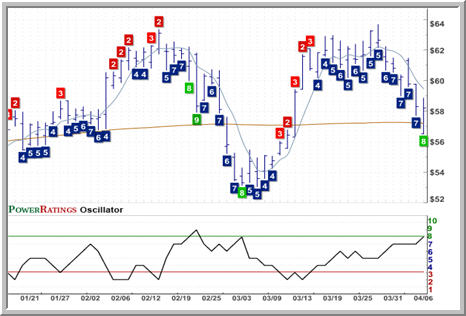

Lastly, another option outside the gold patch is Edwards Life Sciences

(

EW |

Quote |

Chart |

News |

PowerRating), an 8-rated stock that closed higher on Monday and is up again today, but still has a very low 2-period RSI of less than 2. This, I should underscore, is an exceptionally low, 2-period RSI for a stock and something that traders looking for extremely oversold opportunities should keep an eye on.

Recall that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days, according to our research into short term stock price behavior.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.