PowerRatings Review and Update: VRTX, NDN, ZEUS

Three of the five stocks in my last PowerRatings Report, “5 PowerRatings Stocks for the Next 5 Days” remain stocks that high probability mean reversion traders should keep their eyes on over the next few days – particularly if we get additional weakness in the market. Those three stocks are as follows:

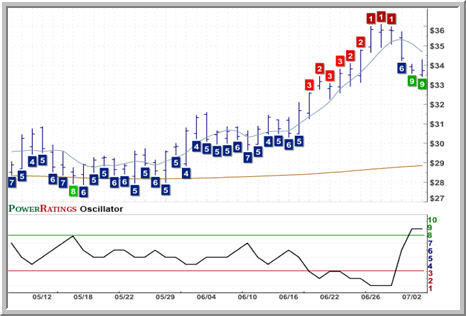

Vertex Pharmaceuticals

(

VRTX |

Quote |

Chart |

News |

PowerRating) has moved sideways in a very tight range over the past few days. This sideways trading has helped relieve the stock’s exceptionally oversold condition – VRTX has closed with a 2-period RSI of less than 8 for the past two days.

VRTX has a PowerRating of 9. Recall that 9-rated stocks have outperformed the average stock by a margin of more than 9 to 1 after five days according to our testing.

Also moving in a more or less sideways direction in the short term are shares of 99 Cents Only Stores Inc.

(

NDN |

Quote |

Chart |

News |

PowerRating). This stock gapped down on Thursday and rallied on Monday, and so far on Tuesday, the tug-of-war between buyers and sellers continues.

The bounce in NDN has been enough to propel the stock into overbought territory above the 200-day moving average. However, it is worth noting that NDN broke down from an extended consolidation in setting up the recent pullback. Should the stock run into resistance as it advances, a subsequent pullback could present renewed opportunity.

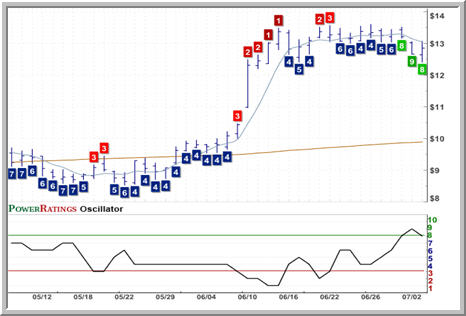

The third stock in today’s report – and the most oversold one in early trading on Tuesday – is Olympic Steel

(

ZEUS |

Quote |

Chart |

News |

PowerRating).

The stock is trading around Monday’s lows currently and, by not falling further, the stock’s 2-period RSI has edged higher somewhat. That said, ZEUS remains oversold above its 200-day moving average.

With regard to the other two stocks in my last report, both Visa Inc.

(

V |

Quote |

Chart |

News |

PowerRating) and eBay Inc.

(

EBAY |

Quote |

Chart |

News |

PowerRating) have remained somewhat under selling pressure, and have PowerRatings that have been downgraded to 7. Any further weakness in these two stocks may be enough to bring their PowerRatings back into the 8 or higher range – at which point they will potentially become attractive again as trading candidates.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of more than 14 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.