PowerRatings Trading Strategies: Miners, Materials in the Spotlight

With traders beginning to respond to increasingly overbought market conditions with some aggressive profit-taking, many of the stocks that had been pulling back over the past few days have begun selling off in earnest. This will provide excellent opportunities for traders looking to buy stocks on intraday weakness.

Learn high probability strategies for trading top PowerRatings stocks! Click here

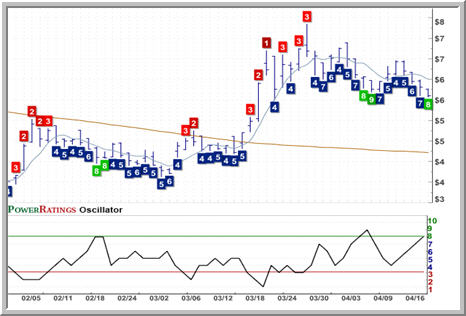

In particular, a number of mining stocks have been under pressure in recent days and some continue to be during the early sell-off Monday morning. Ivanhoe Mines

(

IVN |

Quote |

Chart |

News |

PowerRating), a stock that earned a PowerRating of 9 as of Friday’s close, was down for seven consecutive trading sessions going into Monday’s trading and is now, intraday, below its 200-day moving average. Northern Dynasty Minerals

(

NAK |

Quote |

Chart |

News |

PowerRating), a stock with a PowerRating of 8 that had been down for the past four days, is trading lower again on Monday, off by more than 3%.

In my most recent report, 5 PowerRatings Stocks for the Next 5 Days, I listed five stocks that traders should keep an eye on over the next few days, especially for signs of intraday weakness that could provide lower cost entry opportunities. This list included two gold/mining related names — AngloGold Ashanti

(

AU |

Quote |

Chart |

News |

PowerRating) and Seabridge Gold Inc.

(

SA |

Quote |

Chart |

News |

PowerRating) — both of which were actually moderately higher.

The fact that a number of gold stocks are starting to attract buyers might be a positive sign for those, such as IVN and NAK, which are still in pullback mode. As these stocks become increasingly oversold — and both of these stocks have truly entered extreme oversold territory — the more likely their share prices will be deemed too low to ignore, attracting both new buyers as well as those who bought shares at these low prices before and are looking for another move higher.

Although not a gold or mining stock, materials company Terra Nitrogen Company

(

TNH |

Quote |

Chart |

News |

PowerRating) has closed lower for the past four consecutive sessions above the 200-day moving average and looks likely to make a similarly low close today on Monday. With a PowerRating of 8, TNH has an extremely low 2-period RSI of less than 2.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.