Quants vs Animal Spirits & 3 PowerRatings Stocks

Economics and investing have truly swung radically away from their original roots. Quantitative analysts with advanced physics, math and complex financial degrees have taken over the way we evaluate the economy and individual investments.

In fact, rare is the investment fund that does not have at least one PhD quantitative analyst on its employment roster. Making models, tweaking models and programming has become the de rigueur requirement for anyone who makes investment decisions. In other words, Quants have taken over Wall Street.

The bane of Quants is things that fall outside of their models. These out of the box occurrences happen with disturbing regularity throwing the carefully crafted models out the window. The famous economist, John Maynard Keynes, called these forces, animal spirits. His exact quote in his 1936 book “The General Theory of Employment, Interest and Money” reads as follows:

“Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than mathematical expectations, whether moral or hedonistic or economic. Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as the result of animal spirits – a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.”

Clever traders use the “animal spirits” to their advantage by buying stocks that have been beaten down thus attractive to the spontaneous urges of others to buy. Using a very basic quantitative framework – not requiring a PhD to understand – we have determined when these “animal spirits” are most likely to trigger a buying response to trigger a short term gain.

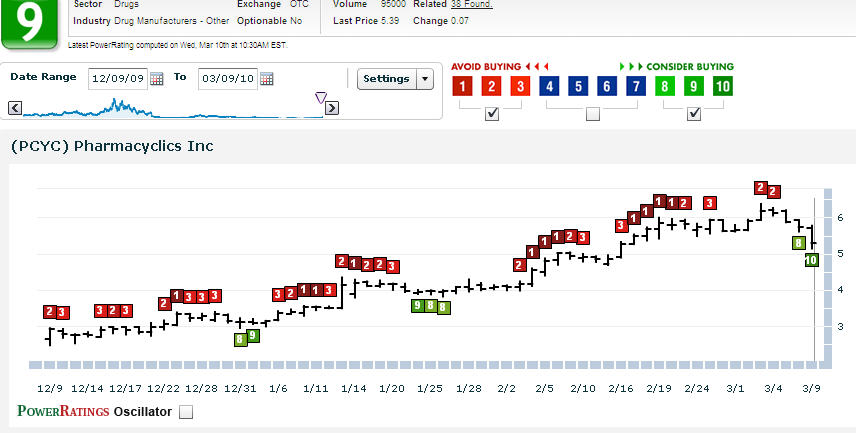

Here are 3 highly ranked PowerRatings stocks that appear poised for short term gains:

^ETM^

^ARG^

^PCYC^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.