Reasons For Optimism & 5 PowerRatings Stocks

Every stock market sell off seems to awaken the perma-bears from hibernation. Despite ultra positive signs of renewed vigor in the economy, the prophets of doom continue to do what they do best. That is to cause fear and trepidation in the investing public.

The most recent of these media darlings, doom prophets is Howard Davidowitz of Davidowitz & Co. He preaches to anyone who will listen that the United States is broke. The economy is “careening down the road of fiscal instability, over indebtness, ballooning interest payments, and declining living standards”, he stated in a Tech Ticker interview.

Davidowitz believes the current bull market in stocks is a suckers rally. He states that the economy will experience tremendous pain pulling out of this situation. He points to Japan as an example of what he forecasts.

Well, Howard and the other perma-bears, the United States isn’t comparable to Japan and you are dead wrong with your doom and gloom forecast.

Not only are corporate earnings surging and forecasted to continue to climb, the basic building block indicators of the economy are showing very positive growth signs.

All one needs to do is look at history to clearly see how the United States has experienced similar situations in the past and was not just able to survive them, but emerge stronger and better than before.

The same type of economic growth pessimism occurred in 1975 and 1982. Many bears were screaming that the end was near and the economy is damaged beyond repair. Most interestingly is the stock rally that occurred on the way out of the 1982 recession. This was also called a suckers rally prior to the 1980s boom years.

Just like individual stocks pulling back prior to advancing, entire economies express the same behavior. The U.S. economy has been in a long term uptrend since the nation was formed. Pullbacks happen, but U.S. history proves that they are merely a launching pad for the next advance.

Here are 5 PowerRatings stocks ready to make short term bullish moves:

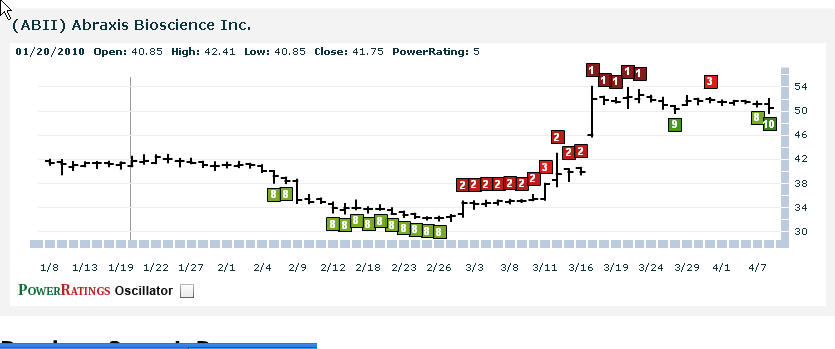

^ABII^

^HUSA^

^NIV^

^TASR^

^SHLD^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

Backtested on over 17,000 trades test this new trading indicator for Leveraged ETFs and find high probability setups daily – click here now.

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.