Recognize It

The

Generals showed up in time to

lift the Nasdaq 100

(

NDX |

Quote |

Chart |

News |

PowerRating) from the hole and it was sorely needed. While

the NDX traded down to a 2173 intraday low, the Semis and some of the Chosen

Ones remained green, showing exceptional relative strength. The NDX rallied to

2251 (or 1.27 times the 2233-2173 leg), then retraced 50% to 2208. Then the

strong afternoon trend took it to 2307, a 6.2% run low to high, and a +4.4% move

on the day.

The Semis, especially the

equipment sector, led the way, as all the stock from my Monday

and Tuesday

commentary had significant moves on increased volume and expansion of range. As

mentioned the other day, the Semis had run up from 72 to 125% as a group from

the recent bottom, then retraced from one half to two-thirds of that move, with

stocks like

(

NVLS |

Quote |

Chart |

News |

PowerRating) retracing 50% and converging with the 50-day EMA and the

top of its base breakout at 36.

Most all of the Semis also

popped on Tuesday, giving us profitable continuation long trades early on, but

they faded in the afternoon as the market sank after Greenspan’s mumbling. The

big moves yesterday were by

(

KLAC |

Quote |

Chart |

News |

PowerRating)

(+17.2% on 77% more than its 30-day average daily volume);Â

(

AMAT |

Quote |

Chart |

News |

PowerRating)

(+13.4% on twice it volume);

(

NVLS |

Quote |

Chart |

News |

PowerRating) (+14% on 69% more volume);

(

MU |

Quote |

Chart |

News |

PowerRating)

again (+12% on 50% more volume); and

(

TER |

Quote |

Chart |

News |

PowerRating) advanced +12%. In

the Broadlines,

(

IDTI |

Quote |

Chart |

News |

PowerRating) popped 15% and

(

INTC |

Quote |

Chart |

News |

PowerRating) chipped in at +5.2% on a

42% increase in volume.Â

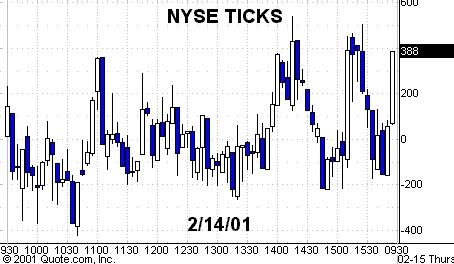

The Generals were clearly

on a mission in the Semis because the market dynamics were showing you declining

volume 2 to 1 over advancing volume and approximately 600 decliners over

advancers, with both the SPX and Dow red, yet the Semis were green, along

with some of the chosen ones. That

only happens when the Generals are in competition to buy stock.Â

When there is that kind of

competition between the Generals, you get the explosive Slim Jims and

first-consolidation breakouts to new intraday highs. No

guesswork involved, just following the money. You have the Semi

list I gave you, so just work it for setups both daily and intraday. When

the Generals have enough stock in and stop feeding at the trough, the stocks

pull back and hopefully set up again. Your job is to recognize it — not predict

it. Suffice to say, the enthusiasm

must spread before the major averages give your 401K mutual fund holdings any

boost.

The best-looking Chosen

Ones yesterday in price and volume were

(

JDSU |

Quote |

Chart |

News |

PowerRating),

(

VRSN |

Quote |

Chart |

News |

PowerRating),

(

CMVT |

Quote |

Chart |

News |

PowerRating)

and

(

QCOM |

Quote |

Chart |

News |

PowerRating). CMVT recrossed the 200, JDSU reversed its December 37 bottom,

QCOM closed in the top of the range and above its 10-, 20-, 50- and 200-day EMAs

which are all within 3 points of

each other. The Generals love to play the game at these convergences. VRSN

reversed four closes and its most recent

January low of 58 1/4.

Those of you who attended

my New York seminar got a VRSN confirmed buy pattern entry yesterday because

even though the 200-day EMA slope is down, the stock is more than the required

percentage below it.

|

(March

|

||

|

Fair Value

|

Buy

|

Sell

|

|

5.15

|

6.35Â |

3.80Â

|

Pattern

Setups

Needless to say,

(

KLAC |

Quote |

Chart |

News |

PowerRating),

(

AMAT |

Quote |

Chart |

News |

PowerRating),

(

NVLS |

Quote |

Chart |

News |

PowerRating),

(

MU |

Quote |

Chart |

News |

PowerRating),

(

IDTI |

Quote |

Chart |

News |

PowerRating) and

(

TER |

Quote |

Chart |

News |

PowerRating), the biggest

gainers on volume yesterday, should be on your screen for pullback setups and

maybe second entry continuation moves, but only on trade-through entry. Be

careful if you decide to play one of these on an extended intraday short.Â

Also

setting up are

(

AMD |

Quote |

Chart |

News |

PowerRating),

(

LLTC |

Quote |

Chart |

News |

PowerRating),

(

TXN |

Quote |

Chart |

News |

PowerRating),

(

IRF |

Quote |

Chart |

News |

PowerRating) and

(

VTSS |

Quote |

Chart |

News |

PowerRating).

They were up in price yesterday, but lagged in volume.

Have a good trading day.