Several Intraday Ichimoku Setups

We are seeing several pairs moving towards possible sell signals on the 30m Ichimoku charts.

#1) is the EUR/JPY which is currently below the Kumo (cloud) but is showing strong Momentum readings and CCI all pointing to the next short term move up. However there is good fib protection from the last downleg (134.50-130.75) all the way up to 133.00 which is also the M3 pivot and the 50% fib/daily pivot below in the mid 132 region. If these hold (particularly the latter) and we see a sell-off to follow, look for a downward crossover of the Tenkan (white line) and the Kijun (red line) below the cloud. This would represent a strong Ichimoku sell signal and suggest we will attack the 131.50 and 130.75 levels with a break targeting the 130 big figure and possibly the Fib Projection around 129.00.

#2) The GBP/JPY is also possibly setting up for one but the price action leading to the sell off is not really impulsive but more corrective in nature. Also the cloud/kumo construction is quite smaller particularly around the daily pivot so this may not put up as much of a fight. However Momentum and CCI models are starting from lower levels so we are either seeing weakness or the start of a new upside swing. Look for an attack on the DP and then a tenkan/kijun cross to the downside below the cloud for attacks on 142.50 and 142.15.

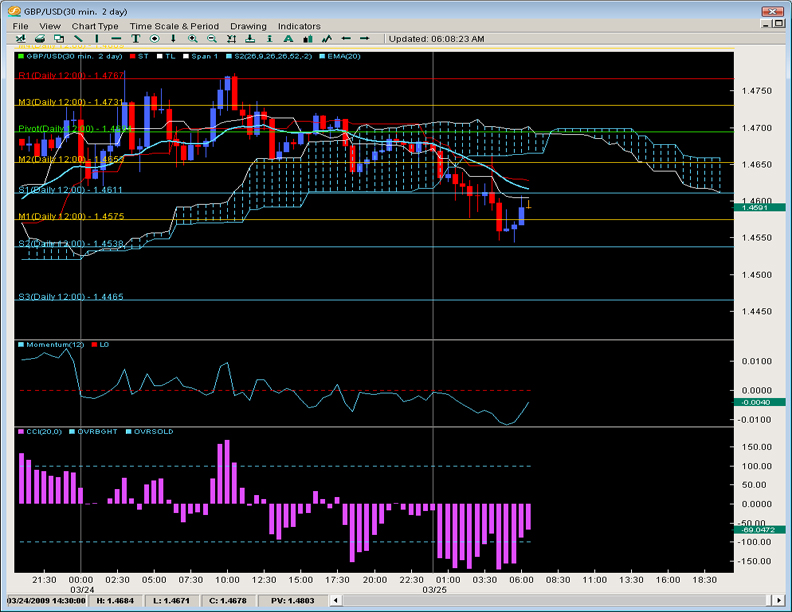

#3) GBP/USD has a similar formation to the GBP/JPY and as such the recommendation and analysis is the same. The only difference is the sell-off has a little more edge and decline to it but doesn’t quite fit the impulsive model. The one thing to note is the one upside attempt today with the candle attacking the 1.4650 region and the follow up rejection down below the S1 pivot. Selling rallies intraday so far has been preferred and its trying to make a second attack to the upside.

Chris Capre is the Founder of Second Skies LLC which specializes in Trading Systems, Private Mentoring and Advisory services. He has worked for one of the largest retail brokers in the FX market (FXCM) and is now the Fund Manager for White Knight Investments (www.whiteknightfxi.com/index.html). For more information about his services or his company, visit www.2ndskies.com.