Short Term Stock Trading: 3 Oversold Stocks for Traders

Buyers remained on the offensive on Wednesday, following through on Tuesday’s surprisingly powerful oversold rally.

A rising tide lifts all boats. And the same is often true when it comes to stocks. Although many of the stocks that I have been mentioning in our Daily PowerRatings Analysis columns have already rallied strongly, there are a few stocks that are trading above their 200-day moving averages but are still in pullback mode. These are the stocks that traders looking for opportunities to buy should be focusing on.

Sigma Designs Inc.

(

SIGM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 15.72

The great temptation, of course, is to buy into markets that have already rallied. Traders are rarely more bullish than when they see other traders piling into a market and driving it higher. But the key to our high probability trading strategies, strategies that have been backtested going back to 1995, is to avoid chasing stocks that have already moved higher and, instead, to spot opportunities in stocks that look to be near the end of their corrections.

Lance Inc.

(

LNCE |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 8.42

It is in this manner that we are able to consistently buy stocks when they are on sale and sell them when demand returns.

Today’s report features three stocks that remain oversold in spite of Tuesday’s massive rally. The 2-period RSIs of these stocks vary from moderately oversold to extremely oversold in the case of 2-period RSIs below or near 2. As I have mentioned this week in other articles, stocks with 2-period RSIs of less than 2, according to our research, have produced positive returns in one-day, two-day and one-week timeframes.

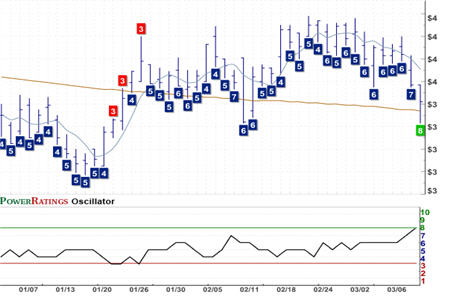

Aurizon Mines

(

AZK |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 2.84

When these low 2-period RSI stocks have high Short Term PowerRatings, as well, they become especially attractive potential candidates for trades to the upside.

Recall also that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.