Staying in Step with the Long-Term Trends

Analyzing trends is the primary role of chart analysis. Monitoring the charts of the major market averages can help traders and investors stay on the right side of the broad market’s trend, and spot changes in the direction of the trend. At a minimum, I suggest regularly monitoring the charts of the following market averages:

- Dow Jones Industrial Average

- S&P 500 Large-Cap Index

- Nasdaq Composite Index

This discussion will focus specifically on analyzing the long-term (primary) trend of the broad market. A long-term trend is one that lasts for six to eight months or longer. A weekly chart of the Dow Jones Industrial average will be used to demonstrate an easy way to monitor the primary trend using the organizing principles of support and resistance.

Within a long-term trend, numerous shorter trends can be observed. Although analysis of shorter trends is outside the scope of this discussion, I encourage market participants, especially active traders, to closely monitor the intermediate- and short-term trends of the market averages. An intermediate-term trend lasts from a few weeks to a few months. A short-term trend lasts from a few days to a couple of weeks (usually less than three weeks). I monitor these trends closely using the daily chart for analysis, and sometimes referring to the hourly chart to see more detail when evaluating the short-term swings.

Monitoring the Long-Term Trend of the Market

While the direction of the short- and intermediate-term trends of the major averages may be influenced by rumor, news and the emotions of market participants, long-term trends are chiefly driven by fundamental factors. The economy tends to cycle between phases of expansion and contraction, which is referred to as the business cycle. Bull markets flourish during expansion phases. Conversely, bear markets tend to coincide with periods of contraction.

It is important to monitor the major averages because the direction of the primary trend of the broad market impacts most stocks. There is an old adage that says, “A rising tide raises all boats.” Thus, in a bullish environment it is usually most profitable to trade primarily on the long side. During a bear market, it is usually best to trade primarily the short side. At the time of this writing, the long-term trend is down. There will certainly be stocks that provide good setups for long positions, but you’ll have to search harder to find them during a bear market.

Many investors do not know how to sell short, or cannot do so in their tax-deferred retirement accounts. Fortunately, there is now an alternative that allows them to profit from a down market: the ProShares exchange traded funds (ETFs). The short and ultra-short ProShares ETFs are designed to go up while the underlying index is going down, and vice versa. The ultra-short ETFs are designed to double the performance of their underlying indexes during a decline in the market. The symbols for the short and ultra-short ETFs for the Dow Jones Industrial Average are DOG and DXD, respectively. For the S&P 500 the symbols are SH and SDS. For the Nasdaq 100 they are PSQ and QID. For more information on this family of ETFs, visit the ProShares web site at: www.proshares.com.

Some groups of stocks will not decline during a bear market, or will decline less than other groups, because they are not as heavily impacted by the phases of the business cycle. Such stocks are referred to as defensive. They include companies whose products or services will be purchased in spite of economic conditions. For example, utilities, health care and consumer staples are considered to be defensive groups. Conversely, during tough economic times, many consumers put off the purchase of non-essential (discretionary) items or services, which can put downward pressure on many stocks, such as those in the retail and leisure industries.

Identifying the Shift from Bull to Bear Market

I felt compelled to write on this topic because in early July 2008, there were a number of news flashes proclaiming that the Dow had entered bear market territory. Those claims came as a result of the Dow declining 20% off its prior bull market high (the October 2007 high). I do not adhere to this somewhat arbitrary “20% rule.” Instead of waiting for a 20% decline in the major averages to determine that we are in a bear market, I let the chart be my guide in determining when the trend has changed direction. And in the case of the current bear market, at least by my analysis, it was evident on the chart several months before the Dow had declined by 20%.

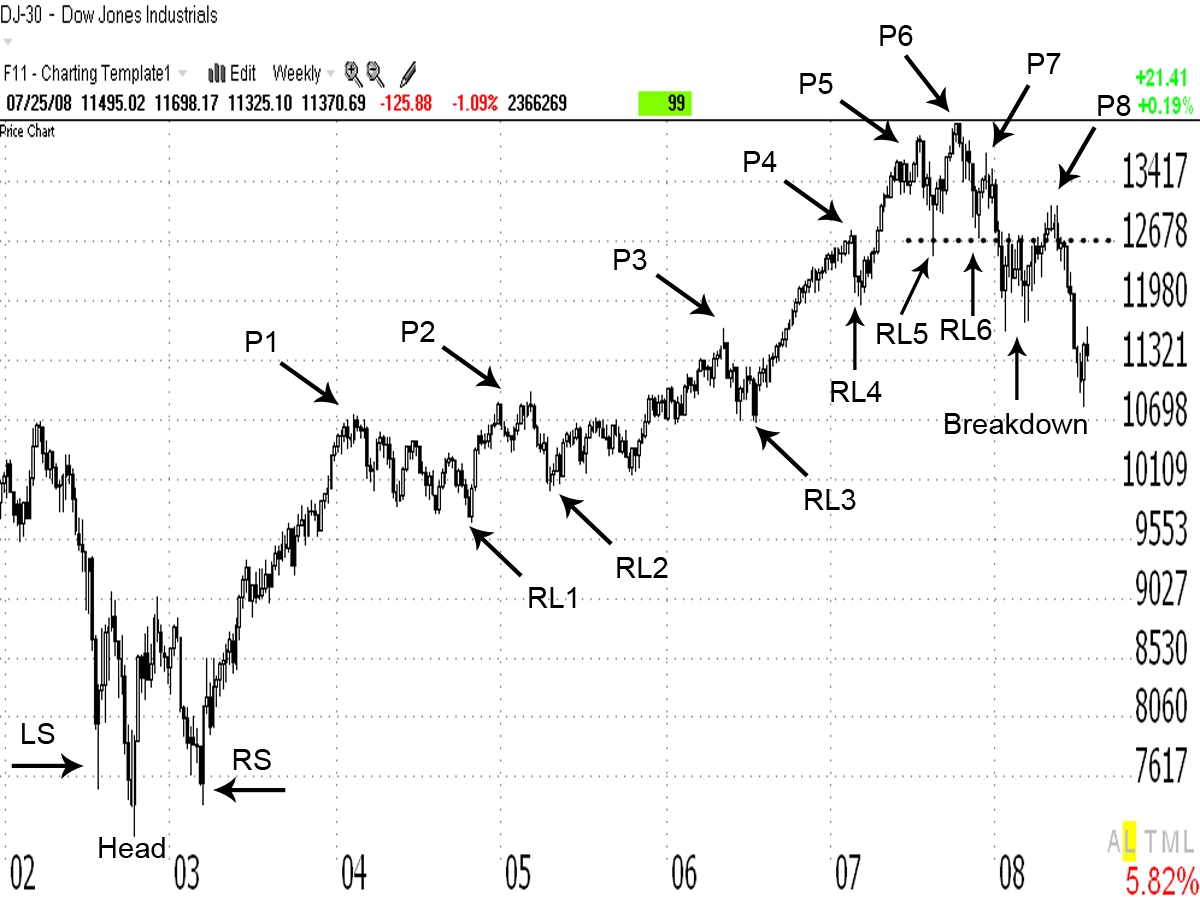

In order to see the transition from bull to bear market, let’s view the weekly chart. It smoothes the “noise” of the daily chart, and allows for analysis of much more data. Figure 1.1 shows a weekly chart of the Dow Jones Industrial Average. The chart has been tightly compressed so about seven years of data is visible. This much data is shown in order to emphasize the shift from a bear to a bull market that occurred during 2002-2003, and the shift from a bull to a bear market during 2007-2008.

In order for a long-term uptrend to keep rising, the index must continue to form prominent rising peaks and rising bottoms (troughs). In a long-term downtrend, the index should form prominent declining peaks and declining bottoms. At the left side of the chart in Figure 1.1, you can see where the 2000-2002 bear market bottomed out between October 2002 and March 2003. In hindsight, we can point to the October 2002 low as the turning point. However, back then, when evaluating that long-term downtrend at the right edge of the chart, it was not yet obvious. The index had made a lower low in October. It was not until that low was tested in March 2003 and provided support that it became so clear that the Dow had put in a solid bottom from which a new bull market could emerge. The fact that the March 2003 low did not exceed the October 2002 low to the downside was a bullish sign.

Figure 1.1 Dow Jones Industrial Average weekly chart (2002-2008). Over seven years of data is displayed in order to demonstrate the shifts between bull and bear markets. Source: TeleChart 2007.

When the Dow bottomed out after the 2000-2002 bear market, it formed an inverted head-and-shoulders, which is a classic bottom reversal pattern. The July 2002 low formed the left shoulder (labeled LS in Figure 1.1). The index declined below the July low in October 2002 and formed the head. In March 2003, the index declined again to near the October low. That higher bottom formed the right shoulder (RS) of the head-and-shoulders pattern. The head was not significantly lower (visually) than the shoulders on either side of it, so some chartists would have interpreted this as a triple bottom. A head-and-shoulders bottom is just a variation of a triple bottom.

After that bottoming action occurred, the new bull market emerged and continued for approximately five years (October 2002 low to the October 2007 high). The most prominent rising peaks that formed on the weekly chart during that time are identified in Figure 1.1 as P1 through P6. After each new peak was formed, price turned down and retraced part of the prior upward move. Those countertrend declines are often referred to as corrections, or reactions. Note: I do not consider minor pullbacks within the uptrend to be reactions; price must correct a significant portion of the prior upmove.

The prominent reaction lows that formed during the bull market are labeled RL1 through RL6 in Figure 1.1. Note that after each reaction, the index turned up again and moved above resistance provided by the prior peak resulting in a continuation of the uptrend. As long as the index is forming higher peaks, and does not close below support at the most recently formed reaction low on a subsequent decline, the long-term uptrend remains intact. As price declined off each higher peak, the index continually formed higher lows (RL1 through RL6) during the bull market. It was not until January 2008 that the index closed below the most recently formed reaction low (RL6, dotted line). That decline pushed the Dow below both RL5 and RL6 (labeled breakdown) which were near the same level. Notice that RL6 was a test of RL5, but it had not closed below its low. That breakdown represented the first time in five years that the index had closed below the prior reaction low. It was at this point, the failure of the previous reaction low to provide support when tested, that I saw strong evidence that the long-term trend was shifting from bullish to bearish, even though the Dow had not yet declined 20% off its prior bull market high.

In addition to the failure of the prior reaction low, the prominent peaks had started to decline (P7 and P8). The peak at P7 showed a failure of the Dow to move above the bull market high set in October 2007 (at P6), which is another sign of weakness. After breaking down through the RL5 and RL6 reaction lows, the Dow turned back up and formed another lower peak at P8. The index rolled over again resuming the downtrend.

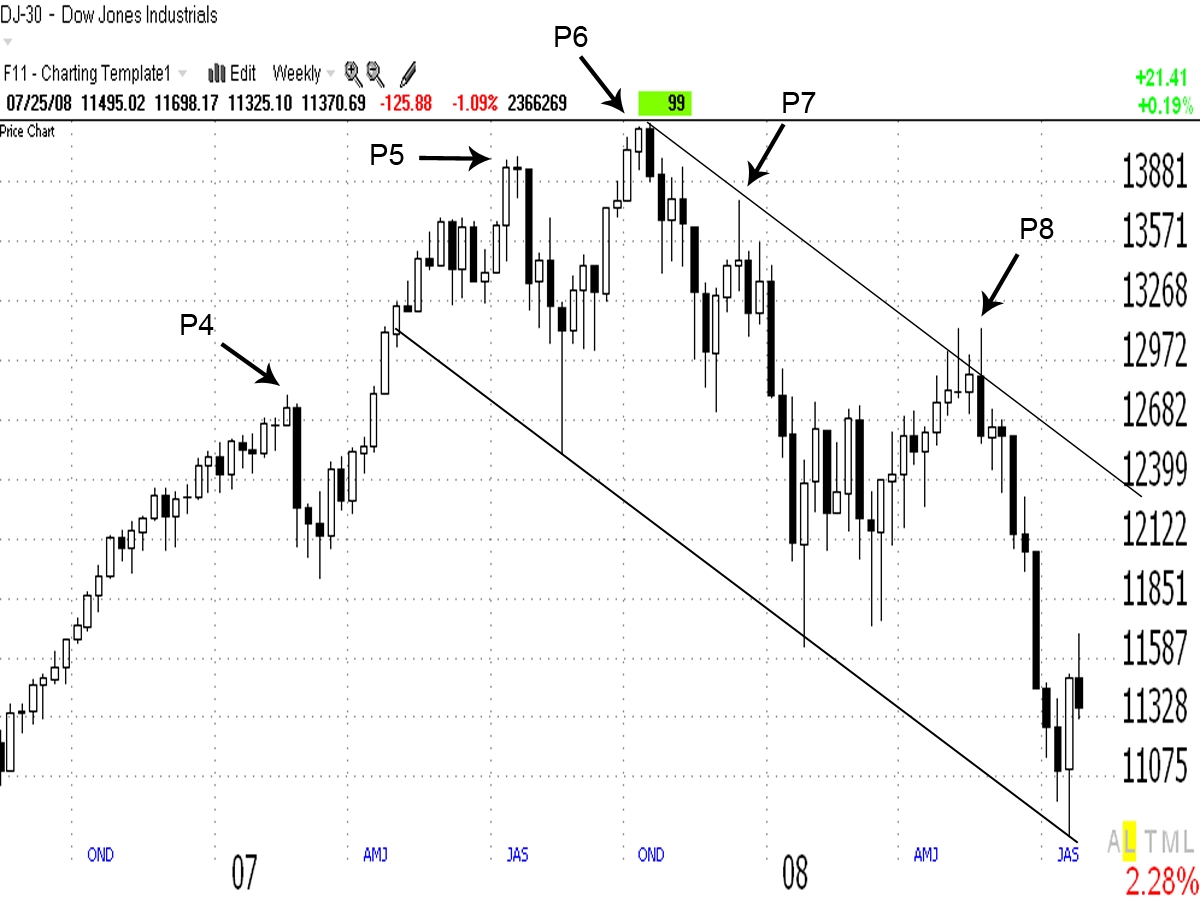

In order for the new bear market to remain in force, the index must now continue to form lower peaks and lower bottoms. The prominent declining peaks are the tops of the upside corrections (reactions) within the bear market (e.g., P8). In other words, strong rallies within the downtrend are just bear market corrections until the bear market is shown to have changed direction. Figure 1.2 shows the weekly chart of the Dow again. The chart is not so tightly compressed, so only about a year and a half of data is displayed. Peaks P4 through P8 that were illustrated in Figure 1.1 are identified again. The focus here is on the price action since the October 2007 high. The index happens to be declining in a channel, which is a fairly common phenomenon. Channel lines have been drawn on the chart to draw attention to the declining peaks and declining bottoms. The upper channel line begins at the October 2007 high and connects the declining peaks. The lower channel line is drawn parallel to the upper line and connects the declining bottoms.

Figure 1.2 Dow Jones Industrial Average weekly chart (2007-2008). The Dow is currently in a bear market. Source: TeleChart 2007 ®

There may be several bear market corrections before a trend reversal occurs. The covering of short positions along with bottom fishing can fuel nice rallies in a downtrend. Astute traders can take advantage of those events to trade the long side; however, they should continue to monitor the long-term downtrend, which can reassert itself at any time. The long-term trend overrides the shorter trends that form within it.

Other Tools for Monitoring the Long-Term Trend

In addition to monitoring the direction of the peaks and bottoms, there are other technical tools that can be applied to the weekly chart. For instance, I watch for divergence between the index and a strong indicator, such as the Moving Average Convergence Divergence (MACD) histogram. I may also draw a trendline(s) on the chart to provide a visual cue when a major support or resistance area has been broken.

Market breadth indicators can be used to gauge the strength of bull and bear markets. Monitoring market breadth, in addition to evaluating the chart, provides a more complete picture of the health of the trend. One of the most commonly used breadth indicators for this purpose is the NYSE New Highs-New Lows. A stock makes a new high when its price reaches its highest level over a period of 52 weeks. A new low is made when price reaches its lowest level in 52 weeks. The NYSE New Highs-New Lows can be compared to the index chart of the New York Stock Exchange. For example, if the NYSE Index is still forming higher peaks during a bull market, but the number of NYSE stocks (its components) that are making new highs begins to decline, it signals a negative divergence and a warning that the uptrend may be weakening.

New Highs-New Lows data is available from many sources. Your broker or charting service may provide this information. It is also available through web sites such as www.Briefing.com. The NYSE New Highs-New Lows Index can currently be viewed free of charge at www.stockcharts.com under the symbol $NYHL. Note: As a general rule, I suggest analyzing New Highs-New Lows data using daily data rather than weekly.

Conclusion

The weekly chart smoothes out the “noise” of the daily chart and provides more data for analyzing long-term trends. The weekly chart can be used to monitor the direction of the prominent peaks and bottoms during a long-term trend. Pay attention to how the index responds when the prior reaction low is tested (bull market) or when the prior reaction high is tested (bear market). This general charting concept, along with a few other technical tools, can help to keep market participants on the right side of the primary trend. However, do not expect to nail the top of a primary uptrend, or the bottom of a primary downtrend using the weekly chart. This should not be considered a precise timing technique, but it does provide a “big picture” view to confirm the direction of the long-term trend and give signals when that trend may be reversing direction.

Use the daily chart to analyze the intermediate- and short-term trends that occur within the bull or bear market. To see more detail of the short-term trends, refer to the hourly chart.

Tina Logan is the author of Getting Started in Candlestick Charting and contributed chapter 8 to Stephen Bigalow’s book High Profit Candlestick Patterns. Tina is primarily a swing trader; however, she also day trades periodically as well as holding longer-term positions. She has been providing tutoring to traders, both one-on-one and to small groups, for several years and has spent thousands of hours trading, testing, designing strategies and developing very detailed and comprehensive training curriculum. For more information visit www.tinalogan.com