Sterling strength: too far; too fast?

Dave Floyd is a professional FX and stock trader based in Bend, OR and the

President of Aspen Trading Group. Dave’s approach to FX combines technical

and fundamental analysis that results in trades that fall into the swing

trading time frame of several hours to several days. For a free trial to

Dave Floyd’s Daily Forex Alerts

or call 888.484.8220 ext. 1.

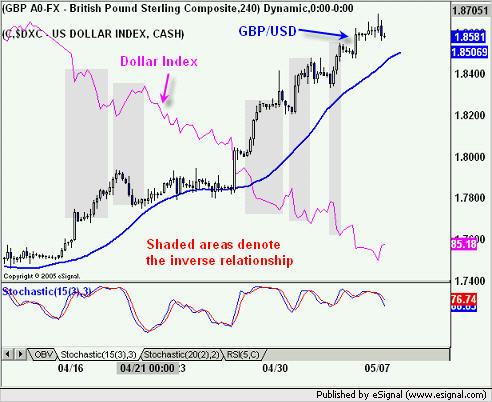

While there is an undeniable inverse relationship between the direction of the

Dollar Index (DXC) and GBP/USD which has played out in the last week or so (see

chart below), the flip side of the equation would question why GBP is so strong

against other, more ‘solid’ currencies?

We are becoming a bit suspect of the exceptionally large move higher in sterling

on the GBP crosses as the fundamental backdrop, historically speaking, does not

warrant such a dramatic rise. Those looking for mean reversion trades will want

to consider shorts in GBP/CAD, GBP/NOK as well as GBP/SEK.

Canada, Norway and Sweden all have positive macro backdrops in terms of the

current account surpluses’ — if the market continue to look for currencies with

more attractive fundamentals, which I think is the case, the crosses noted above

are worth looking at for medium-term shorts (several days to a couple weeks in

duration)

We are also long EUR/GBP based on the same premise.

As always, feel free to send me your comments and questions.

Aspen Trading Group