Stock Market Analysis and Fibonacci, Part 4

In Part 3 TradingMarkets contributor John Jagerson discussed in our series discussed the third most common fibonacci tools used by analysts, fibonacci time studies. To see part 3 of “Stock Market Analysis and Fibonacci”, click here.

Putting fibonacci analysis into practice is challenging and to a certain extent depends on your trading time horizon. Short term traders may treat fibonacci analysis much differently than longer term investors.

However, in either case the analysis can help to time entries and control risk. Fibonacci analysis will work best within the context of a trend, which is not dissimilar to most types of trade timing analysis.

That means that looking for long trades or opportunities to buy stock during an uptrend is likely to be more productive than picking bottoms in a downtrend.

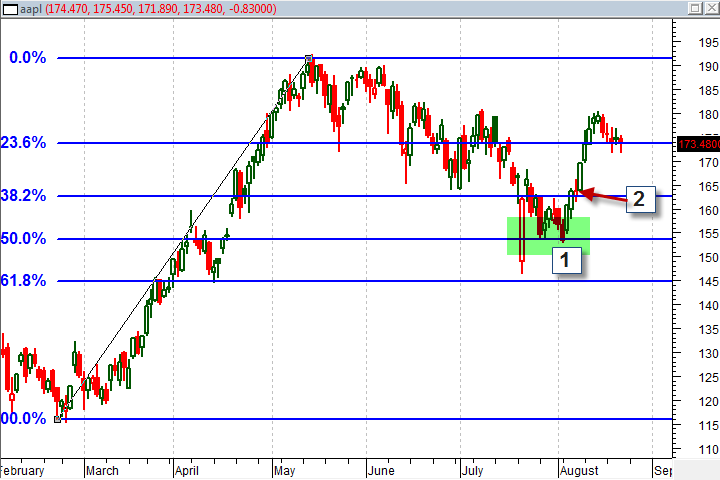

Fibonacci retracements can be used to find a buy opportunity when prices begin bouncing off one of the candidate fibonacci levels. In the chart below you can see a good example of this sort of timing solution on Apple

(

AAPL |

Quote |

Chart |

News |

PowerRating). I would approach this in two steps.

1. Look for the stock to stop or find support at one of the candidate fibonacci support levels.

2. Following the bounce off support and a break of the next fibonacci level enter long.

I like this example because it includes a false start. If you are paying attention to the chart you can see that the stock bounced off the 38.2% retracement level then broke the 23.6% level in June-July before the signal I highlighted in July-August.

It is not uncommon for market prices to bounce from multiple levels before finally breaking out into the previous trend in the long term. What you are trying to do is to use fibonacci analysis to create a trigger to buy in an uptrend when the stock has a high probability of continuing to rise rather than randomly entering a given stock.

This means you may not always hit it at the right time but your probability of being able to enter the market when there is price momentum is now better than random. Using fibonacci like this also helps to create motivation to make a decision and take action.

John Jagerson is the author of many investing books and is a co-founder of LearningMarkets.com and ProfitingWithForex.com. His articles are regularly featured on online investing publications across the web.