Swing Traders Stalking Short ETFs: SKF, TWM, SCC

Stocks are oscillating around breakeven an hour after the market opened on Thursday. With the major markets all in neutral territory between overbought and oversold, swing traders involved in both stock trading and ETF trading will likely have to wait another day or two before quality opportunities begin to materialize.

As Larry Connors noted in a recent commentary for subscribers to one of our trading services (the TradingMarkets Battle Plan), being able to sit patiently on the sidelines while waiting for the best trades with the most significant edges is one of the most important skills a trader can develop.

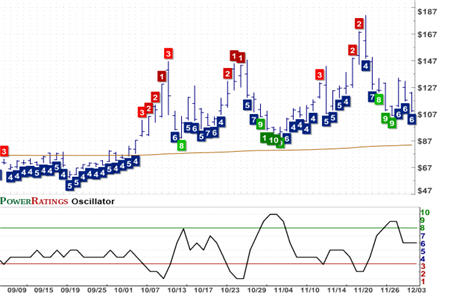

ProShares UltraShort Financials ETF

(

SKF |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 6. RSI(2): 24.63

Think of a top NFL quarterback deciding to throw the ball out of bounds rather than risk a sack or an interception when no receivers are open. Think of a fighter who, rather than just bull-rush his opponent with wild swings, takes his time, jabbing and feinting, waiting for the right opportunity, the right moment, to land the perfect punch.

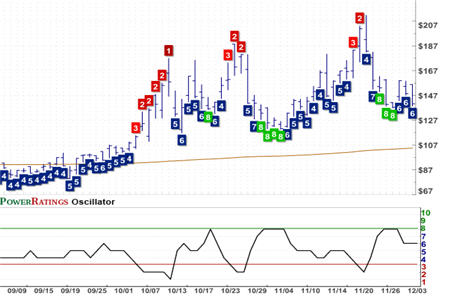

ProShares UltraShort Russell 2000 ETF

(

TWM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 6. RSI(2): 27.62

We are very much in that mode right now, on the heels of some very successful short trades in ETFs and waiting to see whether or not buyers will dare to bid the market higher for another multi-day rally. As I noted in previous commentary, our strategy will be the same if they do so: looking to buy high Short Term PowerRatings short and inverse ETFs as they pull back in the face of buyer’s becoming more and more optimistic.

ProShares UltraShort Consumer Services ETF

(

SCC |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 6. RSI(2): 26.46

There are no such high Short Term PowerRatings short/inverse ETFs right now and we have not yet reached the sort of overbought levels in the market that will earn these ETFs the kind of high Short Term PowerRatings we are looking for. Here, however, are a few short funds we are watching — and that have become even more oversold intraday on Thursday. Should stocks in general move higher, then ETFs such as these in particular will begin to become more attractive.

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click here to find out what traders are saying about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

David Penn is Editor in Chief at TradingMarkets.com.