The Alchemy of Success & 3 PowerRatings Stocks

Alchemy, the ancient system of attempting to turn base metals into gold, has interesting correlations with the stock market. The pre-science Alchemists spent their lives working on systems, formulas and tactics to do the impossible. Therefore no matter how much sense the system made within itself, it failed when applied to the real world.

While great strides where made in unexpected ways by the Alchemists of yore, their basic goals always eluded them. In other words, when tested, their formulas always fell short of success. These ancient researchers remind me of many traders and investors who keep working with trading systems and methods that simply don’t work in the actual marketplace.

They keep tweaking and throwing good money after bad into systems and methods that have proven not to contain an edge. Unlike the Alchemists, it’s unlikely that they will make market discoveries by pounding the same failed tactics again and again. It’s more likely that they will quit in frustration or end up broke eventually.

The human psyche has a strong attraction to trading methods that don’t work. This may be the underlying key to the massive wealth of the marketplace but general lack of success for the majority of participants. The psychologically satisfying methods such as buying highs and selling lows are examples of the faulty Alchemist like methods almost guaranteed to fail over the longer term. Although looking at these “feel good” methods in hindsight they appear to offer an edge; however, proper testing and real life experience prove otherwise.

To obtain success in short term stock trading, investors need to step away from what feels good or right in the market. Systems that are quantitatively proven to contain real edges, despite not feeling right intuitively to most, is what I call the “Alchemy of Success”.

We have developed an easy to use, fully tested system to help you locate shares proven most likely for short term gains. It is a simple 3 step process for picking stocks most likely to outperform over the next week timeframe. This article will explain this simple technique and provide 3 companies fitting each of the steps for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this is counter-intuitive of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

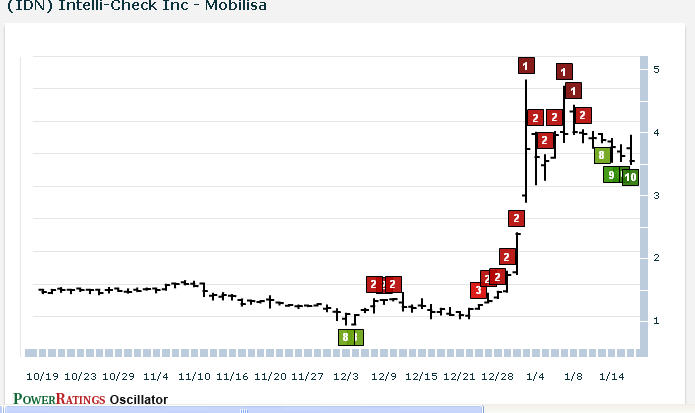

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 3 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

^GAP^

^IDN^

^SCOR^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.