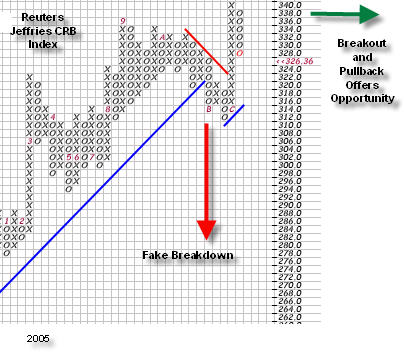

The best sectors to play the CRB breakout

In

my last column I mentioned that I was watching the Reuters Jeffries CRB

Index as it had run into an area of resistance. Its’ ability to push through

that resistance could play an important role in future fed policy. The index did

push through the resistance last week when it went to 338. In fact, what

underlies the index could be ripe for new buys as the Index has now pulled back

within earshot to its 50-day exponential moving average.

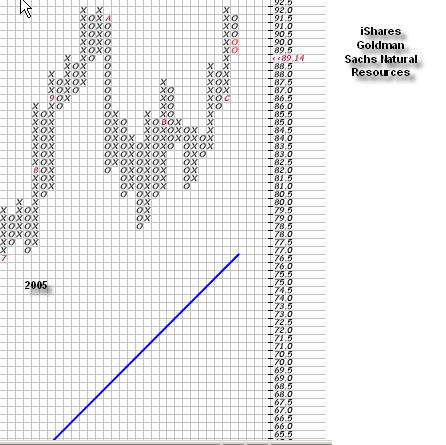

For investors that don’t buy commodities directly, what

sectors should they look at? Personally, I will concentrate on precious metals

and ferrous and non-ferrous metals and oil and steel. If you want to get it all

in one trade, I would suggest the iShares Natural Resource Exchange Traded Fund

(

IGE |

Quote |

Chart |

News |

PowerRating). This will get you some metals exposure without forcing you to make a

bet on one stock. It looks excellent as well in its’ current position for new

buys.

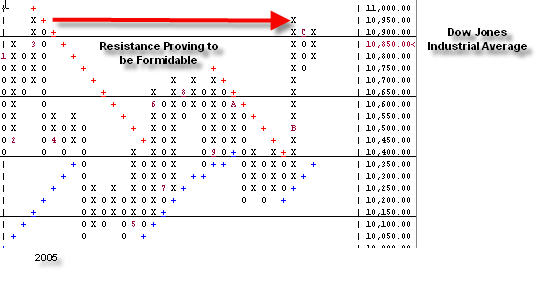

What about what is going with the rest of the market? The

broad indexes such as the Dow Jones Industrial Average, the S&P 500 Index, and

the NASDAQ Composite have unfortunately seemed to stall. I don’t know about you,

but I was hoping for a better end of the year rally. I suppose the resistance on

the Dow at 10950 was more than I had bargained for. Currently, the momentum for

the Dow has also gone to negative. The momentum for the S&P 500 and the NASDAQ

is holding on to positive. Looking at the Relative Strength Indicators for all

three, the market is not overbought. The only logical conclusion for the stall

is the inability for the Dow to get to 11000. Things aren’t bad, but they aren’t

great either. Perhaps we are also feeling an overhang from the regain of the

strength in commodities.

I would recommend holding most positions here for the last two

weeks of the year in hopes for a Santa Claus rally, if there is no reason to get

rid of it. (It hasn’t broken down, but its’ just not performing great). At this

time of the year, you should also consider tax consequences of changes if you

are investing in a taxable account. Any actions made should be made to shift

your allocation more towards stocks related to commodities (see above).

Sara Conway

Sara Conway is a

registered representative at a well-known national firm. Her duties

involve managing money for affluent individuals on a discretionary basis.

Currently, she manages about $150 million using various tools of technical

analysis. Mrs. Conway is pursuing her Chartered Market Technician (CMT)

designation and is in the final leg of that pursuit. She uses the Point and

Figure Method as the basis for most of her investment and trading decisions, and

invests based on mostly intermediate and long-term trends. Mrs. Conway

graduated magna cum laude from East Carolina University with a BSBA in finance.