The best trades are in the FX market

While stock index markets slipped into

their customary holiday stupor, FX markets have remained active as usual.

Considering the fact that currency markets are a far bigger arena than U.S.

stocks in general, holiday seasons have little effect on how the FX markets

behave. That’s a good thing, for those of us who enjoy active, dynamic trading!

Trend View:

GBP/USD (+$10 per pip)

British Pound hit the key 50% resistance of its

major swing lower from August highs to November lows. Price action dropped

nearly -700 pips overall past that market turn. It has recently bottomed at the

long-term descending trendline support, but still remains 100% bearish bias in

its weekly trend chart.

EUR/JPY (+$9 per pip)

EuroYen had nothing but blue skies above it

when trading to 143+ levels, then sold off hard on a straight drop of more than

-500 pips. In the process it blew right thru several layers of support that now

offer resistance instead.

139.80 is the next magnet = ceiling for price

action to test. Above there is venerable 141 where key retracement and long-term

trendline resistance collide, amongst other things.

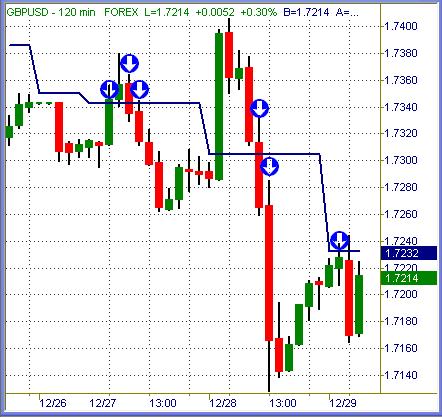

GBP/USD (+$10 per pip)

British Pound has offered pull back short trade signals (blue arrows, hand

drawn) consistently since Sunday night. Some of them occurred at the daily pivot

point, others slightly above. Three different swings of +100 pips, +190 pips and

(currently) +60 pips have been the trade sequence this week. Longs are wrong

right now until the near-term trend changes its strong bearish bias.

EUR/JPY (+$9 per pip)

EuroYen stepped its way upward since Sunday,

with three long trade entry points visible. EURJPY does not cover the same

distance on its chart that GBP or even USDCHF does, but offers methodical price

movement more often than not. The big USD pairs all highly correlate to one

another, while this pair is a change of pace. Now on buy signal again near

139.45 at the time these charts were captured.

Admin Note:

While the FX universe has several major pairs and numerous secondary symbols to

trade, I personally confine 90% of my trading inside two: the GBPUSD and EURJPY.

These symbols are loosely correlated, as opposed to trading GBP and EUR or CHF

which is essentially the same trade.

GBPUSD tends to make the widest swings = trend

moves compared to all others. The USDJPY pair is too sideways buzzy-fuzzy for my

taste, while the EURJPY is just right.

For the most part we’ll profile GBPUSD and

EURJPY symbols in this forum, with occasional guest spots for other currency

pairs. When FX markets are sideways, all pairs are muted. When FX markets are

directional, most pairs offer high-odds trade setups for success.

{Price levels noted by arrows in charts above

are compiled from a number of market measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

Summation

Currency markets have been active & highly tradable thru the entire

month of December. Price action was rather spiky and gyrational at times, but

ability to see thru the “noise” and remain on correct side of trend bias more

often than not makes the difference in results. There is no VIX levels at decade

lows here, no micro-range sessions day after day. The FX is always dynamic,

seldom un-tradable and usually offers swing trade potential in the bigger charts

for ample profit opportunity. What more could any trader ask for than that?

Trade To Win

Austin P

(Weekend Outlook trend-view section…

open access)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.