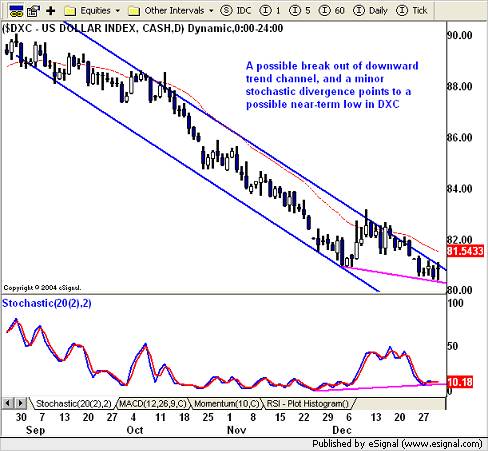

The Dollar Is A Dominant Theme, But Here’s The Bigger Question

While

the weak dollar continuation will likely be a dominant theme/debate as we begin

2005, the bigger question will be at what levels the ECB, SNB and MoF/BoJ

draw the line in the sand and halt the rapid increase in their currencies? With

the dollar index probing recent lows at 80.55, a level which might prove to be a

decent short-term support level, it still is less clear if it can actually be a

level that marks a significant turning point.

Momentum still clearly favors

short dollar positions, but when one looks at the charts of GBP, JPY and NZD,

any firmness in the dollar would likely send these two lower. The JPY still

poses the most delicate of calls given the ever present intervention

possibility. While the BoJ has been absent since March 2004, it would seem that

unless China revalues, the century mark in USD/JPY will prove to be Japan’s line

in the sand. With Japan now seeing recession on the horizon and the subsequent

recovery looking export dependent, look for large scale Treasury buying which

will also stave off the current account financing crisis.

These represent our very

near-term trade ideas as we head into 2005 in addition to our open positions in

EUR/CHF (long from 1.5320 and half the trade still open) and NZD/JPY (short from

73.70). Over the next several days (in the FX Insight Service) we will continue

to expand upon some themes we see for 2005Â

Below are the charts and some

comments regarding possible short positions.

GBP/USD

We are short NZD/JPY for both

technical and macro reasons. Essentially, the risk, from a macro standpoint,

still exists in New Zealand as aggressive tightening in 2004 will eventually

filter down to the economy in terms of slower growth. In addition, it appears

as though the red hot mortgage sector is showing signs of cooling. The fiercely

competitive mortgage price war has shaken out a bit with 2-year fixed rates

having been adjusted higher to 7.6-7.7% after falling in recent months despite

the RBNZ tacking on 150 bp’s on the overnight lending rate.  This will likely

have an impact on the housing sector.

Â

At this stage we believe the

technical back-drop favors a short in NZD/JPY but we see signs that a similar

pattern in NZD/USD might well play out too.

As mentioned last week, we will

be rolling out the FX Insight Ticker later today or on Tuesday. This

will become the primary method of disseminating information throughout the day

(emails will still be sent) given its ability to display updates on your desktop

immediately.

If you have any questions or

comments, feel free to drop me a line.

Â

Â