The Drop Before the Top & 3 PowerRatings Stocks

Market analysts are always arguing about their views of the stock market. It seems to be the nature of the profession not to agree with the majority. Taking the contrarian’s view is the bread and butter of the most popular stock prognosticator.

However, an unusual consensus has arisen recently. Most if not all market pundits are clear in their belief that the stock market is wildly overbought presently. The DJIA is nearly 200 points above its 50-day Simple Moving Average and over 1300 points above its 200-day Simple Moving Average. This is over extended by anyone’s definition. The last time the Dow touched its 50-day SMA was during the first week in November.

What exactly does all this mean? I interpret it as signaling a short term drop soon but the longer term market top is still in the future. Regardless of the market’s sometimes opposite reaction, the recent news can certainly be interpreted with a bearish bent providing the financial press with reasons when the drop actually occurs.

However, no one really knows what the future holds. When considering what will happen with stocks, the father of macro-economics, John Maynard Keynes timeless words should always be kept in mind: “The market can remain irrational, longer than you can remain solvent”.

Fortunately, short term stock traders don’t need to worry about the future direction of the entire market. Proven tools are needed to locate stocks most likely to appreciate over the next 5 trading days. This is without concern for the macro-economic trend of the market. Making short term trading ideal for these uncertain times.

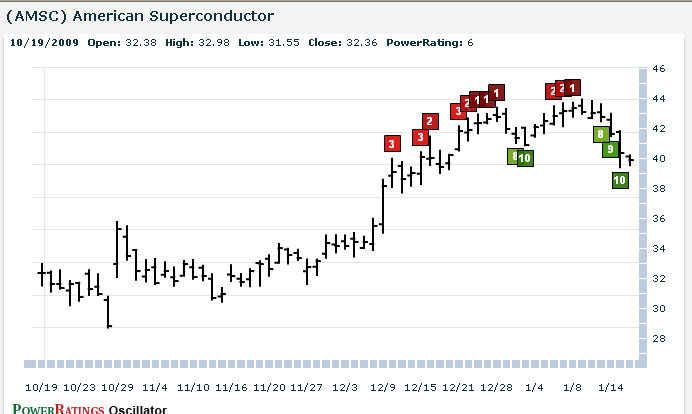

Our Stock PowerRatings are one such proven stock picking tool. They are built upon the study of 8.5 million daily trades from 1995 to 2006. It is a ranking system of 1 through 10 with 1 representing the worse performers and 10 being the best performers. The system gauges stocks probability of outperforming against the S&P 500 over a 5 day period. Statistics clearly show that 1 rated stocks perform 5 times worse than the S&P 500, while 10 rated stocks outperformed 14.7 times the S&P 500 during the next 5 trading days.

As you know, past performance is no guarantee for future success, but our PowerRatings have proven time and time again to locate stocks primed for short term gains.

Here are 3 top PowerRatings stocks for your consideration:

^AMSC^

^LVLT^

^NVMI^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.