The Future’s So Bright & 3 Bearish PowerRatings Stocks

“The Future’s so bright, I have got to wear shades” these sarcastically toned lyrics to the one hit wonder 1980’s band, Timbuk 3’s song of the same name seems appropriate for the current economic climate.

In fact, they seem to have been written for the stock market since the DJIA dipped below the 10,000 mark less than a month ago. On the surface, things really couldn’t look much better. The employment situation is showing improvement. Internationally things appear to be stabilizing and most measures of economic activity in the United States are up swinging.

Even the beleaguered housing market is looking up per the latest Zillow data. Greed is trumping fear at the present time due to the surface optimism.

Scratching the surface reveals a massive government deficit incurred to prop up the economy. Hopefully, the economic engines will kick in, carrying the economy higher without the help of the government.

There is no question that taxes will have to be raised to absorb some of the deficit. I shudder to think of what will occur if the Feds are forced to keep pumping money should the pullout plan fail.

Right now, the United States is at a fulcrum point. Balanced between renewing the most powerful economy on earth or slipping to 2nd tier status. It all depends on how our elected officials handle the growth triggered by the stimulus. Hopefully, the future is brighter. Regardless of what happens in the overall economy, there will always be stocks that are oversold and due for a pullback.

These companies are prime candidates for short term short trades.

We have developed a simple 3 step plan to locate companies most likely to drop over the next 5 trading days. Remember, these same principles work whether or not an overall market drop occurs. In other words, they are stock, not market specific.

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this flies in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

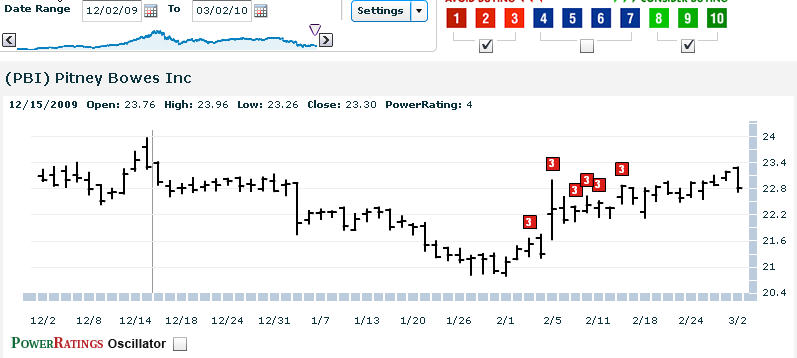

The third and final step is a combination of whittling the list down even further by looking for names whose 2-Period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names prepped for a bearish move soon:

^PKY^

^THRX^

^PBI^

David Goodboy is Vice President of Marketing for a New York City based multi-strategy fund.