The insurance sector offers the best rewards

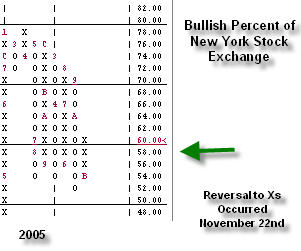

Last week, after the

breakouts in most of the major indexes the week before, the New York Stock

Exchange Bullish Percent reversed to positive. For those of you

unfamiliar with this indicator, it is the main breadth indicator that

practitioners of the point and figure method follow. In order to reverse to Xs

(or begin to rise) 6% of the stocks on the New York Stock Exchange have to issue

new buy signals. A buy signal is when the current column of Xs is able to rise

above a previous column of Xs, or, said another way; the stock is able to go

higher than it has in the recent past. After the reversal, this indicator is

bullish and suggests that investors be long stocks to the fullest extent allowed

by their asset allocation (risk tolerance).

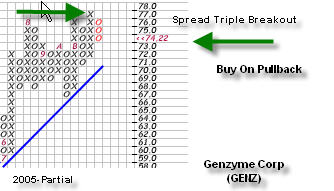

The “conundrum†if you will with all forms of technical analysis is that you

wait for the demand for the stock or index to grow to the point where it looks

stable enough to buy and the breadth indicators start to improve. But, once that

happens, perhaps the market has gotten to the point where it is too late to buy

and that most things are overpriced. Investors can help mitigate some of this

risk by buying on pullbacks.

In general, I approach entry points by first

waiting for the breakout and then buying on the reversal. Or, I will buy a

portion of the position on the breakout and then buy the other portion on the

pullback. The risk of course is that after the breakout you don’t get a pullback

and you never get the position. Or, if you buy on the breakout, the stock pulls

back and you are stuck with a higher cost than is desirable. Of course, I also

always review oscillators such as stochastics and RSI in order to help me with

the decision.

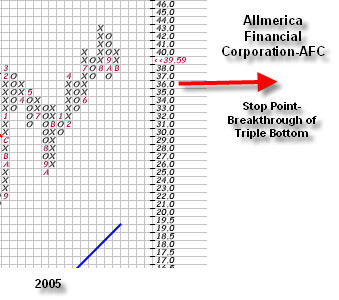

The Big Three (DJIA, SPX, and COMP) all have an RSI over 70 and are looking

quite overbought. Also, the %D of all three is over 90, another indication of

being overbought. So, the indexes will likely slow down here. However, there are

still some bargains (if you will) in individual stocks. Out of the sectors that

I like the most, stocks in the Insurance Sector seem to still be under owned.

Specifically, I would recommend Allmerica Financial Corporation

(

AFC |

Quote |

Chart |

News |

PowerRating).

Should the stock go to $36.00, investors should consider selling it.

Â

Sara Conway is a

registered representative at a well-known national firm. Her duties

involve managing money for affluent individuals on a discretionary basis.

Currently, she manages about $150 million using various tools of technical

analysis. Mrs. Conway is pursuing her Chartered Market Technician (CMT)

designation and is in the final leg of that pursuit. She uses the Point and

Figure Method as the basis for most of her investment and trading decisions, and

invests based on mostly intermediate and long-term trends. Mrs. Conway

graduated magna cum laude from East Carolina University with a BSBA in finance.