The market is fixated on one thing: Interest rates

Rumors of the bull market demise are

once again premature. Forget about things like bond yields, oil prices, gold

prices, rumors out of Japan about backing off from their steady diet of propping

the U.S. debt = economy. “The Market” is fixated on the end of interest rate hikes,

and nothing else. “The Market” is merely a collection of people, and people are

human. Human emotion drives their thought process. It is widely believed that

stock markets will overcome all else and skyrocket straight up, never to look

back once interest rate hikes cease.

Maybe, maybe not. For short-term traders, none

of that really matters.

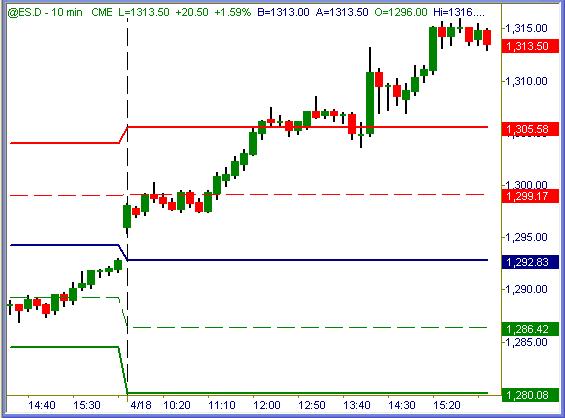

ES

(+$50 per index point)

S&P 500 futures broke above 1300 early on, and

that was all she wrote from there. Total buy-side bias all the way up… another

15 points of profit range with nothing but buy signals to follow every dip.

Absolutely no valid reasons why every emini trader in the world wasn’t buying

this chart, making money hand over fist in the process.

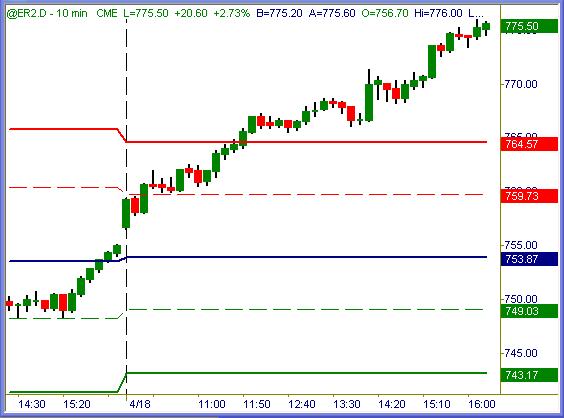

ER

(+$100 per index point)

Russell 2000 futures were 100% buy-side biased

once they broke above Monday’s session high. After that, it was blue skies and

buy signals all the way. Monstrously profitable potential… something we will

see much more of inside year 2006. Count on it!

ES

(+$50 per index point)

S&P 500 staged a big bounce off key support

(note where Tuesday’s open was) and sailed +20 points higher from there. Nice to

see normal range sessions returning once again… and we will see some 30pt or

greater range sessions this year as well.

Right back into the sideways congestion range:

needs to take out recent highs on strong volume with emphasis to negate the

weeks’ long consolidation.

ER

(+$100 per index point)

Small caps went vertical, right to recent highs

that capped Tuesday’s emotional ascent. How this potential double-top is dealt

with will go a long ways toward resolving the next sustained swing move to come.

Summation

Tuesday’s session was simple but very difficult. The simple part came from any

viable intraday method either giving predominantly or solely long signals from

bell to bell. That’s clear & simple. Any so-called trade method that gave more

sell signals than buy signals is total junk, pure rubbish and should be

discarded before the opening bell today. Yesterday’s 20pt ES range will be

matched and eclipsed many times within this calendar year. Traders who rely on

failed methods that only perform in sideways, low range sessions will face a

world of pain in the weeks and months ahead… until their trading capital runs

out. Those traders are known as “liquidity” for the market itself.

The difficult part is adhering to a winning

method that gave buy signal after buy signal. Emini traders are conditioned to

short rising markets and buy falling markets. For sure, the majority of emini

traders fought that powerful trend move yesterday in fiscal vain. It takes

awhile to deprogram oneself from the failed logic of trying to time tops and

just go with the market flow.

Yesterday the market flowed north like a river,

and for those who traded correctly it was a bountiful ride. There will be many,

many, many more days this year just like that… prudent traders will be

prepared for the easy wealth they offer!

Trade To Win

Austin P

(Online video clip tutorials… open access)

Austin Passamonte is a full-time professional trader who specializes in E-mini stock index futures, equity

options and commodity markets. Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.