The Market Loves Thanksgiving: 5 PowerRatings Stocks

Thanksgiving week is one of those weeks that has a cyclical up bias in the stock market. Studies have shown that over the last 20 years, the S&P 500 has been up an average of 0.83% during the holiday week. In fact, last year this prime barometer of market health spiked an astounding 12.03%.

Even if you remove the outlier last year, the S&P 500 has returned a positive average 0.24% over the Thanksgiving week time frame. Market quants generally consider this to be statistically significant. While the cyclical odds are for a positive week during Thanksgiving, the sellers seem to come out on the following Monday. The S&P 500 has been shown to drop an average of 0.48% on this day.Â

While this information is interesting to know, it really doesn’t provide any actionable information for short-term stock traders. Although, I have a few cyclical minded friends who would vehemently disagree! Regardless of the week’s bias, there are always stocks that gain and stocks that lose. The bullish short-term trader’s prime job is to locate those companies that are most likely to increase in value over the next 5 days.

Our studies built upon a proprietary data base of millions of trades have discovered a way to firmly place the odds in your favor when choosing stocks for short-term gains. An actionable, easy to follow 3 step system for locating these shares regardless of the week’s cyclical bias has been the positive result of our extensive research. This article will explain the 3 steps and provide 5 stocks meeting the criteria for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long-term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2 Period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short-term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short-term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 5 stocks fitting the criteria therefore primed for short term gains:

Alcatel Lucent

(

ALU |

Quote |

Chart |

News |

PowerRating)

Astrotech Corp.

(

ASTC |

Quote |

Chart |

News |

PowerRating)

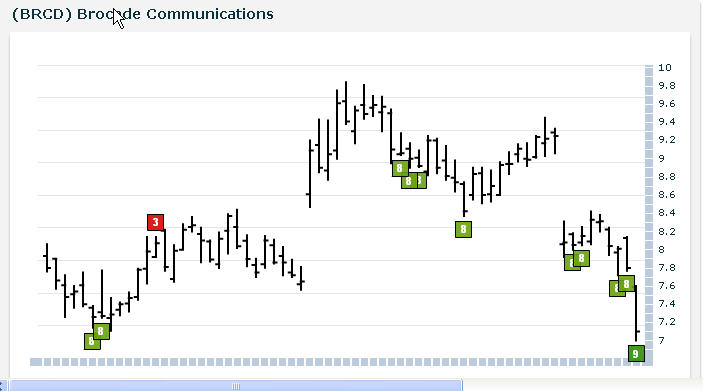

Brocade Communications

(

BRCD |

Quote |

Chart |

News |

PowerRating)

Bronco Drilling

(

BRNC |

Quote |

Chart |

News |

PowerRating)

Corporate Executive Board

(

EXBD |

Quote |

Chart |

News |

PowerRating)

Happy Thanksgiving!!

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.