The New Short Sell Rules: A Traders View & 3 Shortable PowerRatings Stocks

In its never ending quest to subdue and control the free market beast of our own design, the U.S. Security & Exchange Commission recently approved a new rule hampering stock short selling.

Short selling is the practice of borrowing shares from ones broker with the goal of price dropping then selling the borrowed shares, capturing the difference in price as profit. The practice has always had its supporters and detractors. Supporters believe that shorting adds liquidity, provides more opportunity for investors and lowers trading costs. Detractors state that unfettered short selling causes volatility spikes, market panics and crashes.

As late as 2007, the SEC moved to eliminate the depression era uptick rule providing greater freedom to short to short selling traders. The uptick rule only allowed you to short a stock after an uptick, or upward move in price. Although savvy traders had methods called conversions or bullets to legally work around this rule, the elimination of the rule opened up shorting to many more traders and stock situations.

The more rabid among the anti-short selling tribe draws correlations between the squashing of the uptick rule and the fall of Bear Sterns and Lehman Brothers. In the new rule, the SEC attempts to placate the anti-short sellers without causing too much adverse effect on the stock market.

Fortunately, the SEC is finally stating that it understand the true benefits of short selling. The new regulation prohibits short selling of any stock after it has experienced a 10% or greater decline. The rule would go into effect the day of the decline and last until one day after the drop. Why did they choose 10% as the threshold? My research can’t find any studies or empirical data that support this figure.

The new regulation will go into law in 60 days and the exchanges have 6 months to implement it. While I don’t support any governmental interference into the functioning of the free market, this regulation appears to be the least onerous of the possibilities. Given the fact that there is a loud, vocal minority within the government calling for the total elimination of short selling, traders and the free market itself got off the hook easy this time.

This rule will not affect most traders, even those who short regularly. As you know, we believe in shorting into strength, not weakness. In fact, empirical studies have found time and time again that the odds are better for successful shorting when a stock is overbought showing strength. If you follow the basic rule of shorting into strength, the new regulations should have zero effect on your day to day trading activities.

How does one go about locating these companies showing strength but ready to drop in the short term?

We have developed a simple 3 step plan to locate companies most likely to drop over the next 5 trading days. Remember, these same principles work whether or not an overall market drop occurs or not. In other words, they are stock, not market specific.

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this fly in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names prepped for a bearish move:

^NVEC^

^RKT^

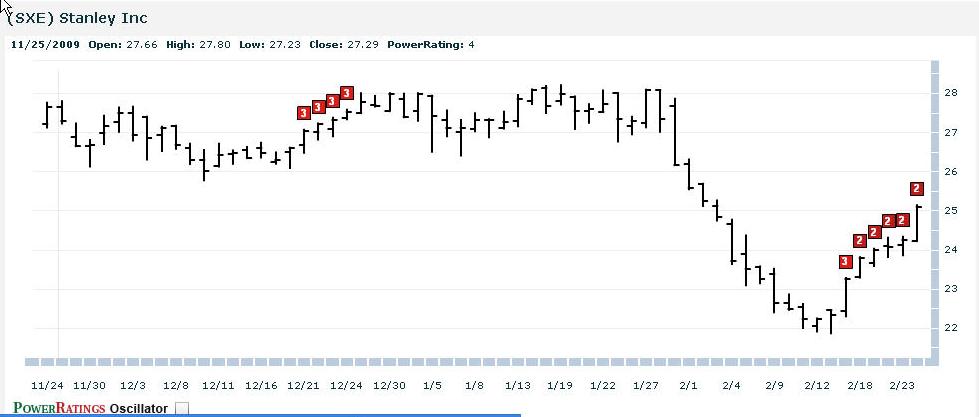

^SXE^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.