The Super Bull & 3 Top PowerRatings Stocks

Bad economic news hit stocks this morning. Unemployment claims have risen surprisingly higher for the second week in a row. In addition, word of home foreclosures experiencing the largest increase in 5 years swept the news wires.

Index futures spiked lower on the data, but within minutes were climbing higher once again. Historically, this type of negative news would have resulted in a substantially more severe and longer lasting reaction in the stock market. Now, with the compression of news reaction time combined with the pure strength of this bullish move, even the most bearish information is being bought.

The multiple long only institutional funds, flush with cash, are laying in wait to buy every pullback, every bearish news story. It’s as if our tactic of buying weakness has been forced into hyper drive. These facts combined with the continual flow of better than expected earnings have created a potential super bull.

This is in no way suggesting that we will not see pullbacks, but it is my contention that all time highs in the DJIA may be the eventual result. Regardless of what occurs, short term stock traders need a proven system to locate companies poised for short term moves. We developed a proven, simple to use, 3 step system for locating these shares.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this is counter-intuitive of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

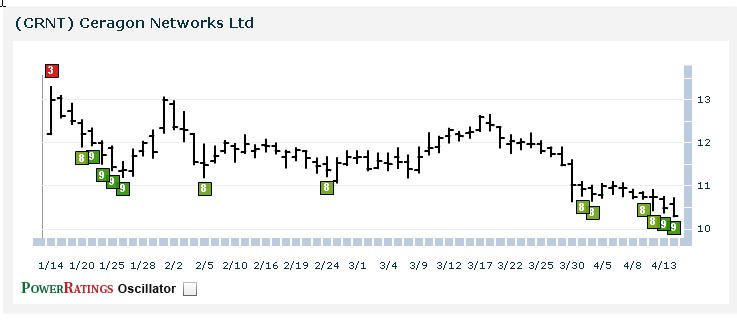

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 3 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 3 top PowerRatings stocks:

^CRNT^

^AET^

^KND^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.