The Surprising Truth About Market Breadth & 3 PowerRatings Stocks

One of the most popular and widely quoted technical analysis tools is called Market Breadth. Barely a day goes by without the financial media mentioning this indicator.

Market Breadth measures the number of stocks advancing over the number of stocks declining during each session. The Market Breadth theory states that the market is believed to be healthy if advancers outnumber decliners.

The wider this spread becomes, the more likely the market is to continuing advancing per the traditional theory. The opposite is also an accepted tenant of Wall Street. When declining issues outnumber advancing issues, the market is believed to be weak thus due for decline.

This Market Breadth theory is well entrenched in the minds of most financial professionals as well as retail investors. A cursory internet search reveals that it is by far the dominant idea regarding Market Breadth.

We decided to take this well accepted theory that seems to make perfect sense, and put it through vigorous, statistically valid tests. What we discovered is quite surprising. Not only is the accepted idea wrong, the opposite proved to be true.

An 8-year period was tested revealing that the traditional wisdom could not be more wrong. We tested advancing issues being greater than declining issues for multiple days in a row, as well as, sessions that advancing issues outnumbered declining issues by a 2 to 1 and 3 to 1 margin respectively. The results of the tests left no ambiguity, traditional wisdom is completely wrong. Here is what our test found out.

Consecutive days of declining issues greater than advancing issues on the NYSE has led to higher prices short term. We considered one week being short term for purposes of this testing. The testing also discovered that significant underperformance occurs when advancing issues outnumber declining issues when the market is trading under its 200-day Simple Moving Average. Another finding that flies in the face of conventional wisdom is that weak breadth days outperform strong breadth days over the short term.

It makes so much more sense to trade on the side of statistics and solid testing than to merely accept Wall Street’s often wrong wisdom.

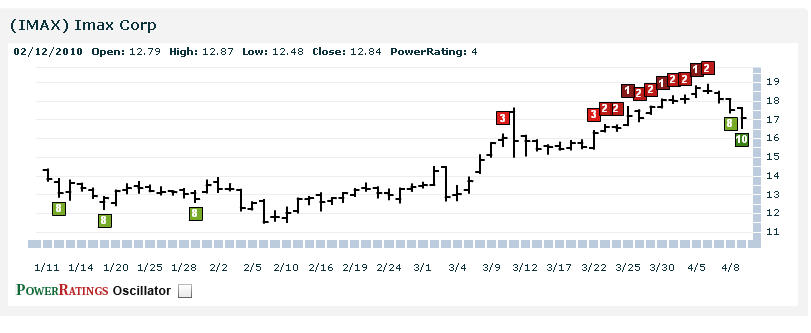

Here are 3 top PowerRatings Stocks poised for short term gains:

^IMAX^

^ZUMZ^

^ANN^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.