The Truth about Large Moves & 3 PowerRatings Stocks

It often appears that the only stocks getting attention are those that have just made large moves. The financial press really doesn’t care about the direction, but seems to focus on shares that have just made 5, 10 or greater percent gap type moves.

When stock gaps higher, it attracts many investors who believe it has “broken out” therefore will be heading higher. The reverse is also true. When a stock gaps down, investors often look to short, saying the stock has “broken down”. As with most common investor knowledge, these ideas about large sharp moves continuing in the same directions don’t always stand up to testing.

In fact, we have found that the opposite is often true. Large price declines outperform large price gains but not in all cases. Our studies discovered that large declines in the SPX outperformed the average day by a better than 2-1 margin after 2 days and after a week.

However, large positive moves in the SPX also led to out performance. This was not true with the NDX. Large drops in the NDX have outperformed large gains. This teaches us that large drops are normally followed by sharp positive moves. The edge exists in buying the weakness of the gap down, not buying the strength of the gap up in most cases. This fact is all the more apparent in shares trading above their 200-day Simple Moving Average. Of course if you are looking to short stocks, the opposite is also true much of the time. These studies support our basic premise that buying weakness is a superior strategy to buying strength.

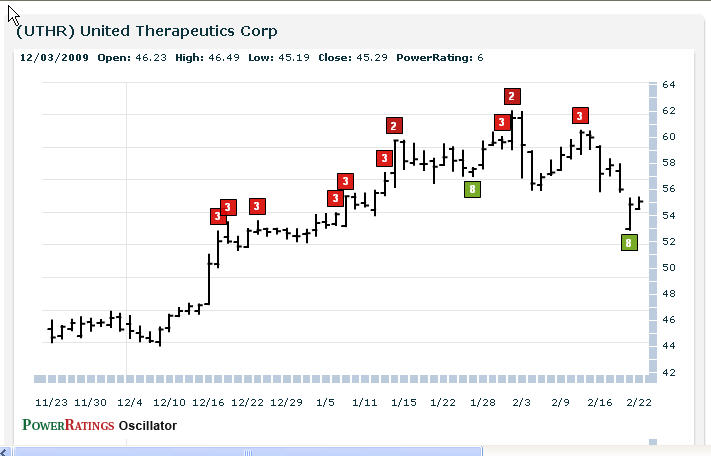

Here are 3 PowerRatings stocks that have just gapped down and may be setting up for a short term bounce back:

^UTHR^

^CPST^

^LOPE^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.