The Ultimate Cage Fight: Buffet vs. Munger + 3 Bullish PowerRatings Stocks

The ultimate metaphorical cage fight may be brewing in billionaire investor, Warren Buffet’s long time team. Buffet and his business partner, Charlie Munger appears to be on opposite ends of the economic philosophical spectrum.

Munger recently published an article, or more of a parable, about the rise and fall of an imaginary country named “Basicland”. Obviously, Basicland is a pseudonym for the United States. In not so veiled language, he writes about the imminent fall of American capitalism due to what he sees as the “casino mentality” of the economy. Very few positive words are mentioned and the reader is left with an empty, end of the world feeling.

If someone of Munger’s statue is so negative about the future of America, certainly it’s a bad sign! Well, fortunately, the Oracle, Warren Buffet, isn’t near as negative as his long time sidekick. Just this morning, in what may have been an attempt to temper his partner’s apocalyptic article; the Oracle granted an interview to CNBC.

He clearly stated that the worse is over in the economy. His exact words were “We got past Pearl Harbor, We will win the war”. Although he remained very cautious about the health care situation, his positive demeanor was in stark contrast to his partner’s cynicism. Hopefully, Buffett wins this disagreement and swings Munger over to his side.

If, however, Munger prevails by negatively influencing Buffett, it could potentially lead to a self fulfilling prophecy. Time will tell if this disagreement develops into the ultimate investment cage fight. I believe Buffet will quickly swing Munger over to his side. Regardless of what occurs, the fact remains that his investment strategy is rock solid. Just this morning, he stated that his enthusiasm over a stock is in direct proportion to how much it has fallen. Of course, Buffet invests for the long term, but his concept of buying weakness fits perfectly with our short term stock trading strategy.

We have discovered a simple 3 step plan that uses Buffet’s “buy weakness” rule and applies it to the short term. This article will now lay out these 3 steps then provide 3 names for your short term consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this is counter-intuitive of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

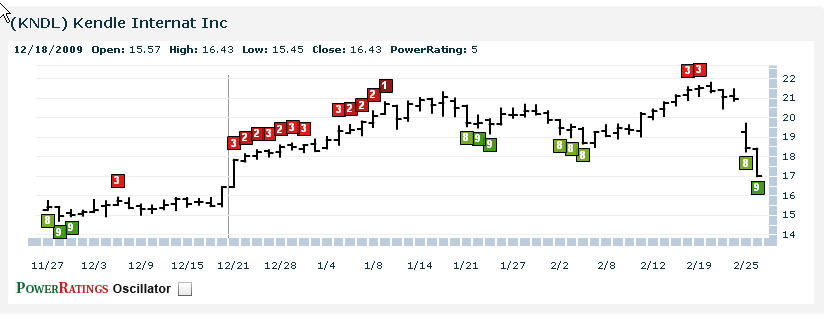

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI)2 is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 3 companies fitting each and every of the above steps:

^CCOI^

^KNDL^

^GPOR^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.