The Volatility Crater & 3 PowerRatings Companies to Benefit

The VIX or volatility index has been cratering since October 2008 when a high of 89.53 was hit. In April 2009 the index dropped below its 40-week Simple Moving Average and never breaking back above to date. This downtrend has jeopardized multiple volatility trading funds, actually causing several to close up shop as their strategies failed to function in the extreme decline.

Pundits are now projecting a VIX of 15 in the near future. 15 is solid technical support on the weekly chart. Should the VIX break 15, 10 becomes the next solid technical support level on the chart. What does this mean to short term investors? Let’s first define what the VIX is, then explore that question.

The Volatility Index or VIX was first put into practice in 1993. It is built upon a paper written by Professor Robert Whaley. The index measures the implied volatility of the S&P 500 over the next 30 days. Specifically, it is a weighted blend of prices for a range of options on the S&P 500. These options are priced based on the expected volatility or price changes over the next 30 days. In mathematical terms, the VIX is the square root of the par variance swap rate for the next 30 days. I know that’s a mouthful, an easy and useable way to think of it is the number represents the expected percentage move of the S&P 500 over the next 30 days on an annualized basis. This figure has been as low as 9% and as high as 89% since the VIX was started.

Truthfully, knowing the macro history of the VIX has very little practical benefit to short term stock investors. It makes sense for longer term market studies/analysis but for the day to day stock trader/investor it has very little to no impact on the daily movement of individual equities.

Unless you are a volatility trader, it is much more important to have a solid system to locate companies most likely to outperform than to be focused on every move of the VIX index.

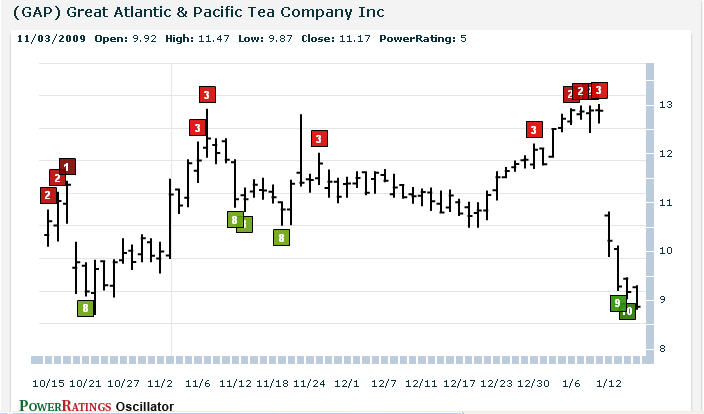

Here are 3 PowerRatings stocks ready for short term gains:

^NR^

^WPP^

^GAP^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.