These 2 charts remain in focus

Will the third time be the charm?

Crude oil is again getting close to its’ previous established resistance at

around $69.50. Whether or not the price of the continuous crude oil contract ($WTIC)

gets above that resistance level could have profound implications in my

investment strategy going forward.

If it does break out, I will continue along the same course of being over weight

in the commodity driven sectors. If the continuous contract fails at resistance

again, I will pay even closer attention to other indicators in order to

determine whether or not I am still following the correct course of action.

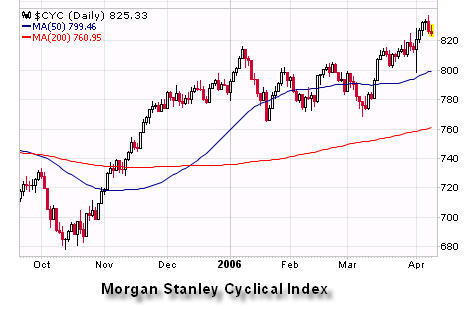

One such indicator is a monitoring of the relative strength of the Morgan

Stanley Consumer Staples Index

(

CMR |

Quote |

Chart |

News |

PowerRating) versus the Morgan Stanley Cyclical

Index

(

CYC |

Quote |

Chart |

News |

PowerRating). Currently, the Cyclical Index is stronger on a relative basis

than the Consumer Staples Index, using both short and long-term measures.

When the Consumer Staples Index is able to overtake the Cyclical Index on a

relative basis, then I will examine whether or not to overweight defensive type

sectors such as food, drugs, and, to a certain extent, healthcare. Until then, I

will stay along my current path, which implies that the economy is still in an

expansion, albeit a late expansion.

Sara Conway is a

registered representative at a well-known national firm. Her duties

involve managing money for affluent individuals on a discretionary basis.

Currently, she manages about $150 million using various tools of technical

analysis. Mrs. Conway is pursuing her Chartered Market Technician (CMT)

designation and is in the final leg of that pursuit. She uses the Point and

Figure Method as the basis for most of her investment and trading decisions, and

invests based on mostly intermediate and long-term trends. Mrs. Conway

graduated magna cum laude from East Carolina University with a BSBA in finance.