These Levels May Be Tested

The September S&P

futures (SPU and ESU) opened Thursday’s session with a 6-point gap to

the upside, after getting a surprise in the form of a big unexpected drop in

weekly jobless claims. New jobless claims came in at 386,000, the lowest level

in almost six months. The size of the gap and the closing discount from

Wednesday’s session gave a good probability that some of the gap would be

filled. Locals were sellers at the open, but after filling two-thirds of the

gap, some of the brokers lined up to buy, catching some of the locals still

sitting short. The squeeze propelled the contract to a new high through R2

resistance at 996.

The lunchtime lull came early as the futures

settled into a tight range, but nevertheless, still holding onto the green. But,

just after 2:15 pm ET, the market cracked in a fine fashion and 15 minutes

later, had erased all the day’s gains. Those looking for a reason for the

breakdown attributed it to rumors that Salomon Bros. had been a big seller of

S&P futures, a small plane had buzzed over the President’s motorcade, and/or the

terrorist alert level was going to be raised on Thursday evening, none of which

was confirmed. The futures continued to slide the rest of the session, before

getting a tiny blip of a short-covering bounce into the close.

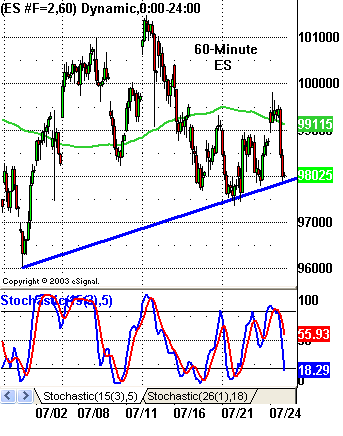

The September S&P 500 futures closed with a loss

of -7.25, just off the low of the session. The contract managed to spike up

through its 20-day MA intraday, but settled right back down in that area between

its 20-day and 50-day MAs. The futures are now facing 3 lines of support

starting with its 60-min trendline going back to 7/1 (see chart) and crossing at

977.50, its 50-day MA at 977, and Monday’s weekly low at 973.50. Volume in the

ES was a hefty 738,000, and a bearish increase over Wednesday’s pace. The VIX

briefly became a teenager again during the session, trading down to 19.63, but

managed to close back above 20.

Friday morning, we have the Durable Goods Orders

report, which is expected to come in at a 1.2% increase following back-to-back

monthly declines. I wouldn’t be surprised at a higher number since Boeing did

report a big increase in orders, but 1 month is just a drop in the bucket of any

sustainable trend. With the way the market ended up discounting the claims news

that it had been waiting 23 weeks to hear, I’ll be looking for those support

levels to be tested early on Friday.

Daily Pivots for 7-25-03

| Symbol | Pivot | Â Â Â Â Â R1 | R2 | R3 | S1 | S2 | S3 |

| COMP | 1714.18 | 1728.07 | 1754.69 | 1768.58 | 1687.56 | 1673.67 | 1647.05 |

| INDU | 9166.78 | 9227.15 | 9341.78 | 9402.15 | 9052.15 | 8991.78 | 8877.15 |

| NDX | 1264.47 | 1276.82 | 1299.80 | 1312.15 | 1241.49 | 1229.14 | 1206.16 |

| SPX | 987.19 | 993.30 | 1005.01 | 1011.12 | 975.48 | 969.37 | 957.66 |

| ESU | 985.75 | 992.75 | 1005.25 | 1012.25 | 973.25 | 966.25 | 953.75 |

| SPU | 985.77 | 992.53 | 1004.77 | 1011.53 | 973.53 | 966.77 | 954.53 |

| NDU | 1265.00 | 1278.00 | 1302.00 | 1315.00 | 1241.00 | 1228.00 | 1204.00 |

| NQU | 1265.83 | 1279.17 | 1304.33 | 1317.67 | 1240.67 | 1227.33 | 1202.17 |

| BKX | 892.43 | 898.32 | 909.51 | 915.40 | 881.24 | 875.35 | 864.16 |

| SOX | 388.62 | 393.75 | 402.72 | 407.85 | 379.65 | 374.52 | 365.55 |

| QQQ | 31.43 | 31.77 | 32.37 | 32.71 | 30.83 | 30.49 | 29.89 |

| SPY | 99.07 | 99.76 | 101.04 | 101.73 | 97.79 | 97.10 | 95.82 |

| SMH | 31.91 | 32.67 | 33.59 | 34.35 | 30.99 | 30.23 | 29.31 |

Fair Value & Program Levels

Fair Value — (0.90)

Buy Premium — 0.02

Sell Discount — (2.78)

Closing Premium – (1.30)

Please feel free to email me with any questions

you might have, and good luck with your trading on Thursday!

Â