This Is The Type Of Market That Normally Follows A Day Like Yesterday

From Tuesday morning’s closing

commentary: “Market action has been rolling = coiling sideways for awhile

now, and breakout or breakdown seems imminent. Unless they save the trend party

for post-Labor day return of prime time season, be prepared for a stair step

trend day higher or lower real soon.”

We saw exactly that prediction play out in

Tuesday’s session. Price action opened near or right at sell signals in emini

symbols before dropping methodically and predictably from there. It was the type

of “money day” that intraday players have potential to really pad their accounts

with.

ES (+$50 per index point)

S&P 500 gave a sell signal confirmed right at

daily pivot resistance near 1234. Once it broke the neutral zone and closed

below 1231, the next short trade signal came in near 1230. Take your pick…

either of them were money.

A couple of late afternoon lifts into

resistance near 1228 were also valid sell signals to end the day. Taken as one

trade or in pieces, the ES offered an easy 10+ points profit yesterday.

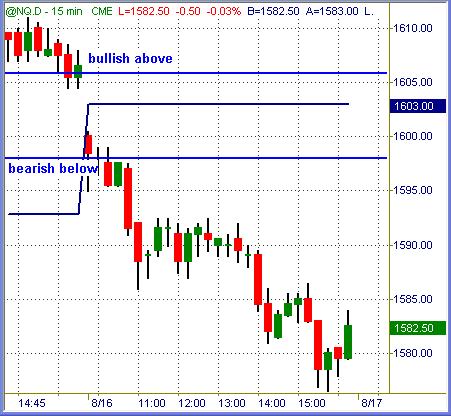

NQ (+$20 per index point)

Nasdaq 100 confirmed its sell signal near 1597,

eventually trading nearly +20pts lower from there. Still the stodgiest (most

stodgy?) emini index of them all, even this day was mildly profitable. Doesn’t

hold a candle to the profit potential = intraday range of Russell 2000 / S&P 400

midcap, so I myself wouldn’t dream of trading NQ right now. For those who do, it

offered decent gains intraday.

YM (+$5 per index point)

Dow Industrial futures were also on a sell

signal below pivot resistance near 10630 as the cash market bells rang. Next

sell signal arrived near 10580, and lows of the day near 10520 made all of those

short entries profitable.

ER (+$100 per index point)

Russell 2000 futures opened right at high

resistance for aggressive sell signals, magnetized right to low support inside

the same opening candle and confirmed sell signals near 661. Late-day lift into

660 resistance was the third sell signal intraday. Any or all of them worked for

at least +$400 per contract… potential for a +$1,000 per emini contract day if

played perfectly. If not, it was profitable regardless.

{Price levels posted in charts above are

compiled from a number of different measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

Professional

Confidence

I get a healthy flow of email from readers, and appreciate it all.

Please forgive me if some of the recent questions go unanswered until Sunday /

Monday… I’m woefully behind last minute tasks for the mini-vacation that

begins tonight.

That said, one of the recurring themes is how

our analysis in here makes trading look so easy. The truth is that trading is

exactly this simple… but simple does not mean easy. The human

decision = emotion element while markets are moving and money is at risk does

skew everything, and that includes 100% mechanical or rules-based systems as

well. When money at risk and the unknown are combined, human emotions affect and

impact everything.

Brett Steenbarger’s website = blog is an

excellent resource for traders wondering why all the super-duper indicators and

endless hours of research have not resulted in massive wealth from live trading.

Trust me, many of the answers to those questions are found in his forum. I have

it hot-linked to my own website for good reason: no individual trader will

create sustained success without knowing the inner secrets held inside each of

us.

There comes a time in every successful trader’s

career where methods = systems = tools used offer solid, methodical profits over

time if applied correctly in live market action. The methods that I use offer

decent profits in sideways swing sessions and significant profits in directional

session like Tuesday. Small range, choppy sessions don’t offer profit potential

for any method, period.

My mindset each day is to expect favorable

conditions for trading success. I take the signals given, shrug off the losses

and (im)patiently wait for the next opportunity to win. Profitable trades are

allowed to work towards +$400 to +$500 per contract gains, and sometimes those

targets are reached. Many times I settle for less on a trailed stop, many times

I’m stopped out at entry for par after a trade goes nearly (but not quite) +$200

in favor.

Glass Half Full

My own individual confidence in trading comes from KNOWING that a number of

sessions, roughly ten of the twenty each month will offer big intraday swings

for solid profit potential. The remaining ten or so sessions each month will be

sideways consolidation of some sort. Roughly half the time is very tradable,

roughly half is un-tradable. It is just that simple and straightforward.

I let the un-tradable days sort themselves out

for me. If I lose three trades at max loss stops, the session is finished for

me. Shut down the computers, walk away and forget about what happens next.

Absolutely no sitting there in front of the screens stewing over woulda –

shoulda – coulda. That day becomes insignificant to future performance and

results.

Days like yesterday where trade signals are

taken and trades allowed to work offer a week’s wages between the bells. Even if

we miss half the entries, stop one trade too soon, etc it is still a very

profitable event. Knowing that the sequence of tradable = un-tradable session

behavior exists and trusting it will hold true is the essence of my success. I

don’t let myself get euphoric after big days or depressed after tough days,

period. Keeping the emotional highs in check will likewise smooth out the lows.

What Wednesday holds for potential is unknown.

Following a directional, normal range session like Tuesday could be continuation

or consolidation. I’m not trading again until next Monday as there are too many

distractions around me today. Monday 8/22 will be my next post in this forum.

I’ll be away from all computer access until Sunday, but I do know one thing for

sure: half of the sessions will be tradable, half of them will not be when

averaged over time. Part of me will miss the next three days, part of me

relishes the break. The trader part of me was appeased yesterday, now it’s time

to step away and play for awhile as well!

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.