Three Top PowerRatings Stocks for Short Term Traders: MDP, LCAV, XTO

With mildly oversold conditions luring buyers into the market Monday morning, a number of our highest PowerRatings stocks — including a number of 10-rated stocks — have already begun to move dramatically higher. Some stocks have even crossed above their 5-day moving averages, a show of strength in stocks that have been pulling back in recent days.

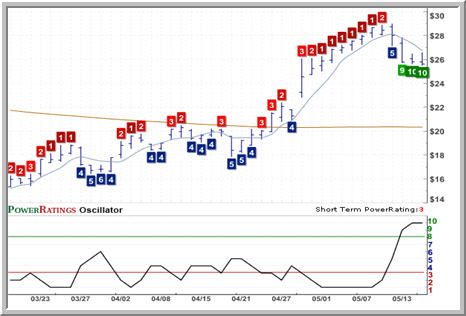

So where are a few of the places traders can look for stocks that the buyers have not already uncovered? Less than half an hour into the trading day, here are three stocks with PowerRatings of 9 or 10 that short term, mean reversion traders may want to watch in the event that intraday weakness helps these stocks pull back even further.

Note that the 2-period RSI values listed are as of the Friday close. If the RSI has changed significantly intraday on Monday, then that development is noted below.

Meredith Corporation

(

MDP |

Quote |

Chart |

News |

PowerRating) PowerRating of 10. RSI(2): 6.08

After soaring through the final days of April, closing higher for 9 consecutive sessions, MDP has run into some serious profit-taking in the form of four consecutive lower closes above the 200-day moving average. MDP’s 2-period RSI intraday on Monday has increased significantly as the stock has edged higher.

LCA-Vision Inc.

(

LCAV |

Quote |

Chart |

News |

PowerRating) PowerRating of 10, RSI(2): 2.42

Also down four days in a row going into Monday’s trading, LCA has also edged higher in early trading on Monday and now has a 2-period RSI above 40

XTO Energy Inc.

(

XTO |

Quote |

Chart |

News |

PowerRating) PowerRating of 9. RSI(2): 10.67

Closing lower for four out of the past five sessions and moving slightly higher on Monday, XTO has pulled back to within three points of its 200-day moving average during its correction.

Remember that based on our historical testing going back to 1995 and including 2008, stocks with PowerRatings of 9 have outperformed the average stock by a margin of more than 9 to 1 after five days. Stocks with PowerRatings of 10 have performed even better, besting the average stock by a more than 14 to 1 margin over the same time frame.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of more than 14 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.