Thriving in Interesting Times & 5 Instant PowerRatings Stocks

One thing is for certain, these are interesting economic times we are living in. Personal incomes and spending are rising yet unemployment remains a major issue at 10%. The Gross Domestic Product (GDP) recently posted its fastest growth in 6 years while President Obama just proposed a record high $3.8 trillion dollar budget.

The Dow Jones Industrial Average DJIA has pulled back from its high just above 10,700, but has found support slightly higher than the technically critical 10,000 level. Stock prices are a representation of investor sentiment. Despite the recent pull back, the stock market remains bullish and investors confident.

However, if you look deeper there seems to be a dislocation between the underlying factors and the surface reality. It’s as if what we are seeing on the surface is smoke and mirrors ignited by artificially low interest rates and Fed liquidity injections. The economic train keeps chugging along despite the deep seated issues. It’s important to keep in mind that there have constantly been economic issues. Yes, the numbers are larger now, but the game between the Federal control mechanisms and the free market forces has never changed.

The bigger numbers on both sides of the equation simply mean greater opportunity for some and perhaps more of a struggle for others. These are indeed interesting times promising great opportunity for those nimble enough to capture the inherent edges. Short term stock trading is one tactic that will allow you the ability to profit in the short term without the long term risk of buy and hold. The trick is the ability to locate those companies poised for short term moves prior to the move taking place.

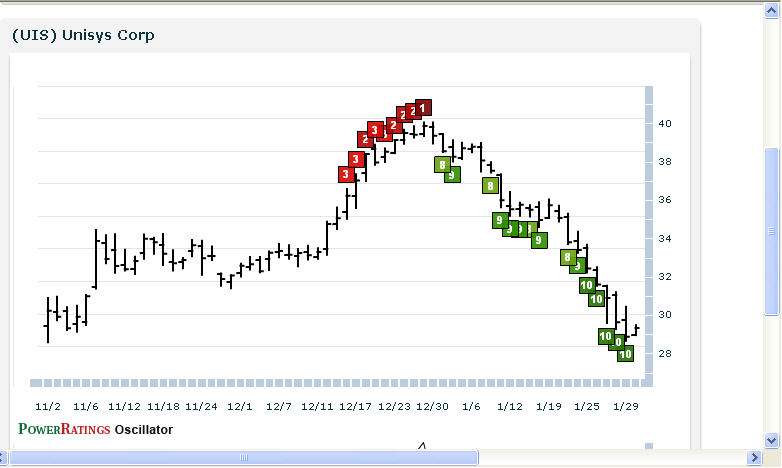

As you know, after you see the move on the chart, its’ often too late to jump on board. We have developed a simple, easy to use stock picking system called, PowerRatings to help you find these stocks ready to make a fast move. PowerRatings are built upon the study of 8.5 million daily trades from 1995 to 2006. It is a ranking system of 1 through 10 with 1 representing the worse performers and 10 being the best performers. The system gauges stocks probability of outperforming against the S&P 500 over a 5 day period. Statistics clearly show that 1 rated stocks perform 5 times worse than the S&P 500, while 10 rated stocks outperformed 14.7 times the S&P 500 during the next 5 trading days.

As you know, past performance is no promise of future performance. However, our PowerRatings have proven time and time again to locate those companies most likely to experience short term gains.

Here are 5 top ranked PowerRatings stocks for your instant consideration:

^CPX^

^EROC^

^FIRE^

^UIS^

^ZEUS^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.