Today’s Trading Lesson From TradingMarkets

Editor’s Note:

Each night we feature a different lesson from

TM University. I hope you enjoy and profit from these.

E-mail me if you have

any questions.

Brice

Give Me Something to

Lean On: Understanding The Purpose Of Chart Patterns

By Dan Chesler

The following is

an edited transcript of a live TraderTalk workshop held by Dan Chesler for TM

members on Thursday, August 1, 2002.

Brice Wightman:

Good afternoon

and welcome to TraderTalk. Today we have with us a gentleman who holds a CMT

designation, has worked as a price risk manager for the Louis Dreyfus

Corporation, and has written articles for Stocks and Commodities

magazine. He began his career in 1988 as a cash agricultural commodities trader.

He currently is a proprietary trader for a NYSE member firm. It is my great

pleasure to introduce Mr. Dan Chesler…

Dan Chesler:

Thank you Brice, for that introduction. And thank you also to all the traders

who have taken time to join us today. Before I begin I just want to say that my

association with TradingMarkets which began in May has been a very happy one.

Most you who have been with TM for any length of time know the quality of the

content contained on this site, and the caliber of people here, are the best in

the business. It is truly an honor to work with folks like Larry, Brice, Duke,

Dave et al.

The topic of my conversation today is on chart patterns. And more generally, on

the subject of trading. Along the way to becoming a full time trader, you really

need to decide what you believe in. You can’t be without some kind of consistent

approach to the market. I’m not mechanical or “system” trader, but I do have a

set of beliefs about the market that took a few years to develop.

Without some kind of roadmap that tells you where you are in the market, you

will be lost. So my advice to any new traders is to take your time until you

find that approach or technique that really “speaks to you.” I use chart

patterns as a means of trading first, and forecasting second.

That probably contradicts what some of you believe about chart patterns. The

truth is most chart patterns are at best a 50/50 proposition. Some are a little

better than others, but overall they’re only mildly predictive. However, chart

patterns serve a very useful function for trading.

How is that? The

goal of my trading is to be involved in the “efficient” portion of the move.

That is, the portion of the market move which travels the greatest amount of

PRICE over the fewest intervals of TIME. The opposite of “efficiency” is a

market that moves sideway, with no net gain or loss.

Simply put,

chart patterns help cordon off the condition that precede this efficient action.

That is what I meant by “leaning” on a chart pattern. Chart patterns are simply

a convenient means of defining: 1. entry price; 2. risk amount; and 3. potential

target.

So again, I am simply “leaning” on a chart patterns as a means of helping me

isolate periods that precede “efficient” action, and as a means of giving me

SPECIFIC

entry, exit and risk parameters. Certainly I’d like to find a pattern that has

90% winners, with the winners three times the size of the losers. Yup. I’d love

that.

But keep

dreaming. The truth — at least in my experience — is that trading is a lot

like sales. In sales, they say if you knock on enough doors, eventually someone

will say “Yes.” Trading is similar. If you take enough trades, eventually you’ll

catch some winners. And what about all your losers?

Here’s the BIG

secret. Your losing trades should be small enough that you are able to have a

long string of losers, while not significantly impacting your trading account.

This allows you to be in position to catch the much smaller number of winning

trades that: a) make up for all your losers; and b) add significantly to your

bottom line.

Think in terms of many small losers, many “scratch” trades, and a much smaller

number of large winning trades. You make your money on these trades, just like

the salesman makes his quota on only a small percent of his total cold calls.

Different business but same theory. Again this all ties into what I am saying

about chart patterns.

The goal is NOT

to try and find that one homerun trade that will make your month or make your

year. think of your results as the SUM of MANY trades, all with very well

defined risk parameters.

So in the

patterns I am going to discuss today, I will be trying to show you patterns that

highlight ‘spots’ where prices spend a minimum amount of time “hanging around.”

Remember, this is a battle of overcoming lots of small losers. So what I’m

looking for are moves away from a “spot” where price doesn’t return anytime soon

(to stop me out or otherwise aggravate me). That’s all I care about. Direction

is almost a secondary consideration.

Two patterns which I use frequently are the

stoch-trap

(ST), and the

incipient trend pattern (ITP). In

addition, I am a big proponent of classical chart patterns. This is a very

subjective area for most folks. In my own trading, after enough years of

experience, I’ve gotten to the point where I know how to treat “subjective”

patterns as objective ones, but I’m not going to get into that topic in this

discussion. Basically it’s a technique that involves distilling the bar chart

down into separate volatility and periodicity components. Maybe we can talk

about that another day.

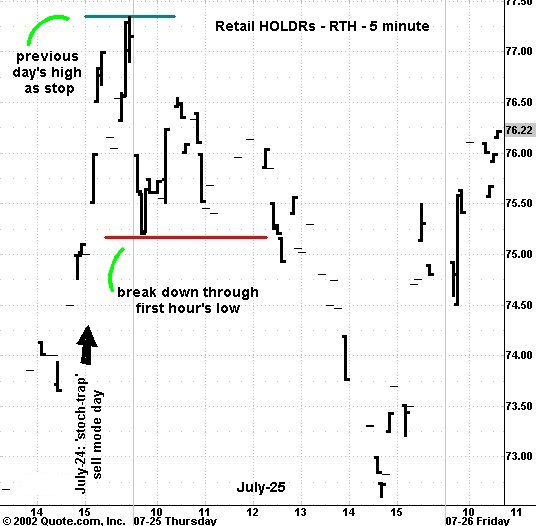

Stoch-trap is a

pattern that can probably best be understood in the context of a “pullback” in

an existing trend. Like other pullback strategies, it attempts to locate that

moment in time where prices have just completed a minor contra-trend reaction. I

use two indicators to identify when the market has reached this point: a trend

indicator such as the 50 period moving average or the 5/35 MACD, and the 4

period fast stochastic as a short term cycle indicator. These are pretty

standard indicators on most charting packages.

Conceptually,

think of stoch-trap as a means of identifying short-term overbought condition in

a downtrend, or conversely short-term oversold conditions in an uptrend. There

are two ways I enter the stoch-trap trade following a signal. The first method

is to place a stop at the high or low of the signal day bar (depending on

whether it’s a buy or sell).

Since we’re attempting to identify a short term cycle turning point, in theory

price should not return to the high of your entry bar (for shorts) or low (for

longs), which makes the high or low of your entry bar a convenient protective

stop level. The second and preferred method of entering a stoch-trap setup,

requires the use of intraday charts.

Following a buy signal, I’ll place a buy stop at the high of the first hour’s

range. Or a sell stop at the bottom of the first hour’s range for a short set

up. I prefer this entry since it gives me better precision. In markets where the

main trend is not particularly strong, stoch-trap trades may only be good for

scalps — however, in a strongly trending market like we had leading up to the

July 24 bottom, you can expect much more follow through and can hold stoch-trap

trades overnight. I’ll answer more questions on stoch-trap in a few minutes

The incipient

trend pattern (ITP) is a means of identifying “spots” (remember my discussion on

spots from earlier) where price spends only the briefest amount of time. ITP

combines the concept of early trend identification, along with a type of

‘break-out’ entry in the direction of the incipient trend. Very simply, I

qualify trend by waiting for a close above (or below) a 10 day moving average.

Following the FIRST close (above or below) the average, I then wait for the

first “contra” open-close sequence bar. For example, the first bar that closes

below its opening price, following the first close above a 10-day average, sets

up an ITP buy signal. In this case, I would be looking to buy the market on a

stop above the high of the contra bar.

I’ll give the

market up to five days (including the contra bar day) before abandoning the

trade, and will also abandon the trade if the market closes below the average at

anytime before entering the trade (penetration of the average is ok, but a close

below is not). The emphasis of both of these patterns, stoch-trap and ITP, is on

defining risk.

Both patterns

give convenient, small windows of risk which we can “lean” on — over and over.

Believe me when

I tell you. I do a LOT of scratch trades. I do a LOT of small losing trades.

Good for my broker but good for me too. Big losers = bye bye trading capital.

Just try to be in position to catch the occasional fat trade, while spending the

rest of the time playing defense. Trading is definitely not a glamorous job

despite what you may think. There have been some academic studies (University of

Michigan) that more or less confirmed the idea that the bulk of stock market

returns where the results of only a small handful of days in any given year.

This goes directly to what I was saying earlier that a) I am trading for the

efficient portion of the move; and b) the efficient moves happen a lot less

often than we wish they would.

Now, I’ll be

responding to some questions.

Wightman:

We have

some questions for you.

Chesler:

Great!

Question:

Would you

consider lowering your long entry point to above the most recent bar of the

pullback assuming there are more than 1 contra bars with lower highs, and

assuming the close is not below the average (reverse logic for shorts)?

Chesler:

Great

question. Shows this person is thinking. My answer is yes, I would consider

lowering my stop.This doesn’t happen too often, but when it does, it will allow

you to keep a smaller stop. That’s a good thing. So, again, I would lower my

entry stop in this case. Protective stop (measured in dollars) would shrink

which is good.

Question:

Dan, do you

suggest using the SMA 50 or the MACD 5/35 as the second condition for a Stoch

Trap? The Stoch Trap strategy I made for TradeStation uses the SMA 50 because

it’s slightly simpler to implement. Also, how did you choose the 5/35 MACD

numbers?

Chesler:

I’ve used them both and there’s not much difference between them. I like to use

the 5/35 MACD for bigger picture analysis, and so if I’ve got the MACD on my

charts, I’ll sometimes just leave it there rather than switching over to the 50

day average. But really it makes very little difference.

Question:

Dan, if

you don’t use charts for forecasting, what do you use? Fundamentals? Or do you

not use anything?

Chesler:

Like Austin

Powers says in his movie, “That’s not my bag, baby!” Forecasting is secondary to

trading. Trading is about making money. The only forecasting I do is in terms of

predicting whether markets are near a point where there are about to move

“efficiently” or not. I don’t care if I get the direction wrong seven times out

of ten times, so long as my losing trades are small. The other three are going

to more than make up for the losers, plus increase my account balance. I think

Brice wants to wrap up now. So thanks again for being here today and good luck

in the markets tomorrow

Wightman:

You bet. Dan, thanks for a fantastic presentation. Thanks again, Dan, and good

trading to all!

![]()