Tomorrow’s Pullbacks: Advanced PowerRatings Strategies for Short Term Traders

What do PowerRatings traders do in between trades?

One thing about being a high probability trader is that there are times, like now, when most traders are safely in cash having taken profits from the recent strength. For PowerRatings traders, the task at hand is to sit tight and wait for the next round of pullbacks to occur.

We never know when the next pullback will arrive. We just know that it will happen and that all that is required of high probability mean reversion trading is to wait for it. Watching baseball this weekend, I was reminded of the old saw that more than anything else, it is “the right pitch†that makes a good hitter. The same is true for successful, high probability trading.

PowerRatings traders can pass the time, though, by looking for places where tomorrow’s pullbacks, those “right pitches†might appear. These are the good stocks, the stocks that are rallying right now, that sooner or later will come under profit-taking, maybe aggressive profit-taking. This is when these stocks become high PowerRatings stocks, the kind of stocks that have outperformed the average stock by more than 14 to 1 in our testing.

But right now, many of those stocks are low-rated stocks, 1s, 2s and 3s. And in the same way that we encourage traders to avoid buying low-rated stocks, traders can use low-ratings to help spot those stocks that are overextended, overbought and increasingly due for profit-taking.

Keep an eye on these stocks over the next few days. The news may be great right now, but their low PowerRatings are telling a different story. Should these stocks come in for some significant profit-taking, then today’s high-flying, low-rated stocks may be the high probability pullbacks of tomorrow.

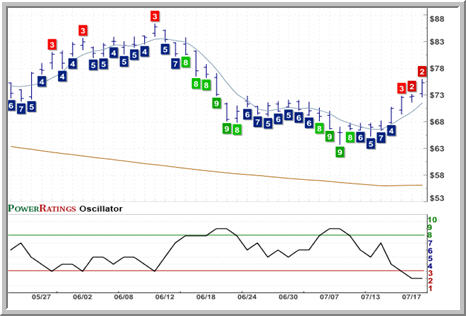

Research in Motion

(

RIMM |

Quote |

Chart |

News |

PowerRating). PowerRating 2. Up four days in a row above the 200-day moving average, RIMM has had a 2-period RSI of more than 90 for the past four trading days.

Cisco Systems

(

CSCO |

Quote |

Chart |

News |

PowerRating). PowerRating 3. Soaring higher for a sixth day in a row, CSCO is increasingly due for a correction. The stock’s 2-period RSI has been above 99 for an eye-popping four days in a row.

eBay Inc.

(

EBAY |

Quote |

Chart |

News |

PowerRating) PowerRating 3. Closing higher for a sixth out of the past seven trading days, shares of EBAY have also been in above-99 territory in its RSI.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of more than 14 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.