Too Busy To Trade? A PowerRatings Trading Strategy for Part Time Traders

Many part-time traders shy away from short term stock trading because they fear that they don’t have enough time to “trade every day”. For many of these traders, “short term trader” is essentially the equal of “day trader” and connotes frantic moving in and out of positions every other minute.

While there are some short term trading strategies that are based on frequent trading, one of the advantages of trading high probability, mean reversion strategies like PowerRatings is that short term traders can tailor the amount of trading activity they do. If a trader using PowerRatings wants to trade more frequently, our PowerRatings provide all the tools to do so. And if a trader only wants to trade a few times a month, our PowerRatings can be an excellent fit, as well.

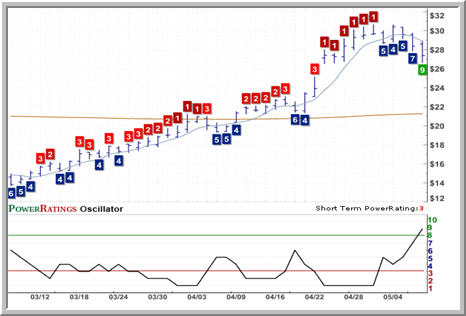

Steve Madden Inc.

(

SHOO |

Quote |

Chart |

News |

PowerRating) PowerRating of 9. Traders with little time on their hands can focus their PowerRatings trading on just the highest rated stocks with PowerRatings of 9 or 10, like SHOO.

How is this the case? Our research into short term stock price behavior going back more than a decade shows that stocks with PowerRatings of 8, 9 or 10 have tended to outperform the average stock in the short term. And the higher the PowerRatings, the greater the potential outperformance. For example, based on our most recent performance statistics, 8-rated stocks have outperformed the average stock by a better than 6 to 1 margin. At the same time, 10-rated stocks have bested the average stock by a margin of more than 14 to 1.

Typically, there are far fewer 10-rated stocks on any given day compared with 8-rated stocks. So a trader who wanted to trade less frequently could limit his or her trading to 10-rated stocks, or 9-rated stocks, and avoid the 8-rated stocks.

Hittite Microwave Corporation

(

HITT |

Quote |

Chart |

News |

PowerRating) PowerRating of 9. Using limit orders that are farther away from the previous day’s close is one way to make sure you taking the least expensive positions possible – it is also a great way to limit the total number of potential trades.

Such a trader would likely find fewer potential trades on a given day. But those trades would likely be bigger winners.

Read more about PowerRating performance in our recent special: PowerRatings Does It Again – Results for 2008.

Here’s another strategy for traders who want to keep their trading frequency relatively low.

We also found that trades taken with limit orders that called for deeper pullbacks also tended to outperform trades taken with limit orders based on more shallow pullbacks. In other words, trades taken with limit orders 6% below the previous day’s close tend to produce greater returns than trades taken with limit orders 2% below the previous day’s close.

The trade off is similar to trading stocks with different PowerRatings: a trader who uses 6% limit orders will have fewer trades over a given period than the trader who uses a limit order of 2%. But those 6% limit order trades are likely to produce better per trade results.

For many PowerRatings traders, a neutral strategy of focusing on 9s and 10s and a limit order that is more than 2% and less than 6% may suffice. But what is important for traders to understand is that whatever their preference – more trades with slightly lower results or fewer trades but with higher per trade gains – PowerRatings trading strategies are flexible enough to help fulfill a variety of trading goals.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of more than 14 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.