Too Hot to Handle: 5 Overbought Stocks for Traders

Most traders look to buy when markets start moving aggressively higher. But traders who look to sell strength rather than buy it know in Wednesday’s strength lies opportunities for traders willing to bet against stocks.

The question is this: which stocks should traders bet against? If the goal of the swing trader is to sell strength, then the most important question is what sort of strength should traders sell?

This is precisely where a lot of traders get into trouble. Seduced by topping patterns after long rallies to new highs, or by technical divergences in leading indicators, too many traders try to make a living out of betting against strong markets. But because they do not distinguish between the true strength of strong stocks and the temporary, false strength of weak stocks, these attempts to sell stocks short often fail.

We are traders, not heroes. We are not interested in being the trader who shorted the top of a raging bull market in a stock. While that might impress friends and family, there is simply no edge in trying to consistently sell market tops. We would much rather bet against stocks that have already shown themselves to be, to put it bluntly, losers.

What do I mean by “losers”? Here all we are looking for are stocks that are in poor technical shape–trading below their 200-day moving averages, for example. That is the first step. The second step is to see these stocks displaying atypical strength, strength which appears out of line with their poor technical condition.

One of the ways we have been able to spot atypical strength is to look for consecutive higher highs. Traders are never more bullish than when stocks are making higher highs. After all, the very definition of a trend is, in part, a series of higher highs in price. However, context is key. When these consecutive higher highs are occurring in stocks that are above the 200-day moving average it may simply reflect a market that, while overbought, is strong. However, when consecutive higher highs are occurring in a market that is trading below the 200-day moving average, it tends to mean something else entirely.

Specifically, our research into short term stock price behavior found that stocks that made five or more consecutive higher highs while trading below the 200-day moving average actually underperformed the average stock in one-day, two-day and one-week time frames. When combined with stocks that have particularly low Short Term PowerRatings of 1 or 2., this can be a powerful edge for traders trying to make sure they are betting against the right stocks when they decide to sell stocks short after a rally.

Click here to read our research into stocks that have experienced five or more consecutive higher highs.

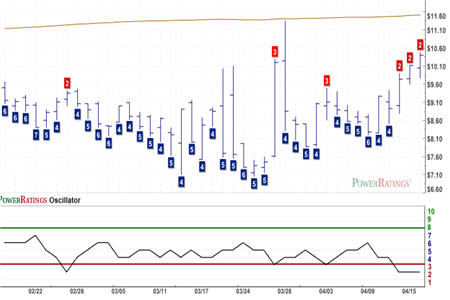

All of the stocks in today’s report have Short Term PowerRatings of 2. Our research into short term stock price behavior revealed that stocks with Short Term PowerRatings of 2 are likely to underperform 90% of the stocks in the S&P 500. This means that all five of these stocks are not just in that category of stocks that traders should avoid, but are also in that group of stocks that traders can effectively and successfully sell short.

In addition to listing the individual Short Term PowerRatings of each stock and their accompanying PowerRatings chart, I have listed the 2-period Relative Strength Index values for each stock. This will make it easier to for traders to understand just how overbought some of these stocks that have experienced five or more consecutive higher highs truly are.

Oplink Communications

(

OPLK |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 97.06

PDL Biopharma

(

PDLI |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 98.04

Pike Electric

(

PEC |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2: RSI(2) 93.60.

Raser Technologies

(

RZ |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 93.01

WebMD Health

(

WBMD |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 98.75

Join Larry Connors, CEO and founder of TradingMarkets, Friday at noon for a special presentation announcing the opening of our Swing Trading College. Our Swing Trading College has been one of our more popular products and we are happy to be making this 14-session, online course available to our readers and subscribers. The Conference Call will last for approximately 30 minutes.

Not only will Larry talk about the Swing Trading College, but also he will share with listeners a new method for swing trading exchange-traded funds, a strategy called “The Double 7’s Strategy” that has performed impressively in historic testing, being correct over 79% of the time in both the NDX and the SPX from 1995 up through yesterday.

That’s Larry live Friday at noon for the TradingMarkets Swing Trading College. Spaces are limited, so click here to reserve your spot today.

David Penn is Senior Editor at TradingMarkets.com.