Top Three Nasdaq Pullbacks for Traders: SMBL, CYPB, CPLA

Traders were in a selling mood in the first hours of trading on Friday, following-through to the downside after the market broke down from overbought extremes on Thursday.

Will selling early lead to buying late? This is the kind of question that bedevils traders trying to divine patterns on the fly. If stocks go up, before they go down, then go up early and then down…It is easy to see how even the best-intentioned trader can find him or herself going astray, with notions and theories about short term stock price behavior jostling against each other like crowded passengers on a rush-hour subway train.

This is why having a simple, straightforward and quantified trading strategy for short term trading can be so helpful — to say nothing of profitable. Such an approach to stocks will help make sure that you are always on the winning side of the market, being among the first to buy when stocks stop falling and near the front of the line to sell when stocks and ETFs end their rallies and begin to reverse.

Smart Balance Inc.

(

SMBL |

Quote |

Chart |

News |

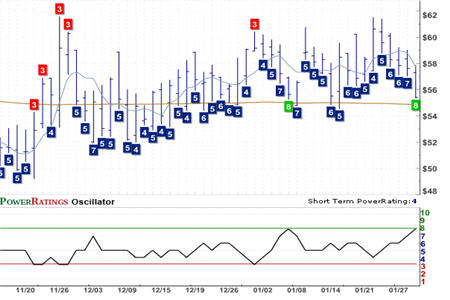

PowerRating) Short Term PowerRating 8. RSI(2): 4.35

Our Short Term PowerRatings are one of the best tools available for short term stock and ETF traders looking to buy low and sell high. PowerRatings take into account trend, momentum, volume and volatility to help short term traders spot those stocks and ETFs that are oversold and likely to attract buyers, as well as those that are overbought and likely to encounter strong selling pressure in the near term. It is our strategy to buy oversold, high Short Term PowerRatings stocks and ETFs after they have pulled back and to sell them as their value recovers and demand for those shares returns.

Cypress Bioscience Inc.

(

CYPB |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 8.54

What’s more, Short Term PowerRatings do not merely represent our opinion of how stocks behave or should behave in the short term. Rather they represent observations and conclusions based on millions of simulated stock trades between 1995 and 2008. It was this testing that revealed to us that the highest Short Term PowerRatings, for example, have outperformed the average stock by a margin of nearly 17 to 1 after five days.

Capella Education Company

(

CPLA |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 3.53

Even those stocks that have Short Term PowerRatings of 8, a high but not our highest PowerRating, can provide significant edges for short term traders. We found that 8-rated stocks outperformed the average stock by a more than 8 to 1 margin after five days.

The next time you see a stock or exchange-traded fund coming off its highs and you feel yourself starting to think negatively about that name, take a moment to check and see what sort of Short Term PowerRating the stock has. If that PowerRating is an 8, 9 or 10, then it may be time to think again: that falling stock or ETF may be a star worth catching.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.