Trading Options, Trading ETFs,

Part 3

Click here to read Trading Options, Trading ETFs, Part 1

Click here to read Trading Options, Trading ETFs, Part 2

In this, Part 3 of our series on trading options on exchange-traded funds (ETFs), we will look at some of the more advanced options strategies that traders using our high probability ETF trading methods may want to consider as alternatives to either straight ETF trading or the simple buying and selling of calls.

Buying and selling of calls (long call, long put strategies), as I noted in Part 2 of the series, is a perfectly legitimate way for traders to trade high probability ETF trading signals. We recommend that traders using options in this way stick primarily to deep in the money options, which more closely track their underlying ETF compared to out of the money options.

There are however other options strategies that work well with high probability ETF trading, strategies that do limit some of the potential upside, but also reduce the amount of risk that traders are exposed to during the trade. For traders who are interested in trading options on ETFs and want to apply a little more active risk management, options spreads strategies can be an excellent alternative.

Options spreads strategies involve buying or selling two or more options with different strikes and expiration months. There are many different types of options spreads. However, one of the more popular options spread strategies is the credit spread. Here, we’ll take a look at how a credit spread might be set up using a recent overbought opportunity in the S&P 500 SPDRS ETF [AMEX:SPY]. (See the SPY trade example from Trading Options, Trading ETFs, Part 2)

Because we are looking at an overbought SPY in this example, we will look at a spread strategy called the bear call spread. A bear call spread also goes by the name of “short call spread” or “short call vertical spread” and involves selling a front month, at the money (ATM) call and buying a front month out of the money (OTM) call.

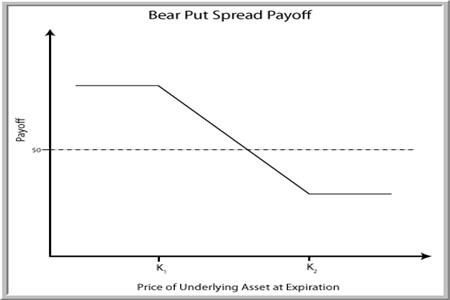

Courtesy of Wikinvest

The trade is called a “credit” spread because of the income initially received from the sale of the (more expensive) at the money call, the proceeds of which help fund the purchase of the out of the money call. The maximum profit for the trade is the difference between the income or credit received from the ATM call sale and the expense of the purchased OTM call.

Traders using spreads like this limit their risk if the underlying moves higher instead of lower because of the purchase of the OTM call, which will increase in value if the underlying advances.

Options strategies like credit spreads are just one example of ways that traders can take the basic high probability ETF trading blueprint and customize it to suit their own trading goals. While more aggressive traders may opt for straight long call/long put strategies, more sophisticated traders – or simply those for whom managing risk is a top priority – will and should consider taking advantage of the sort of flexibility that trading options on exchange-traded funds (ETFs) can provide.

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click here to order High Probability ETF Trading,the first quantified book of trading strategies to improve your ETF trading.

David Penn is Editor in Chief at TradingMarkets.com.