Trading Strategies for PowerRatings Traders: The Waiting Game

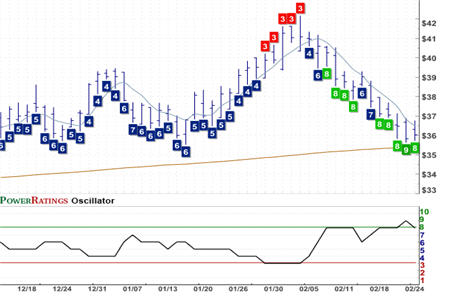

Curious about the difference a single trading day can make? The morning before the big Tuesday rally, our Top 25 PowerRatings roster included 14 9-rated stocks and a pair of 10s. And although it is more an anecdotal point than a statistical one, I’ve noticed that whenever we have a surge in the number of top-rated PowerRatings stocks, the likelihood of the market rallying increases.

Stocks are pulling back in the first hour of trading on Wednesday as profit-taking from yesterday’s advance understandably dominates early action. The number of high Short Term PowerRating trading opportunities has subsided, meaning that now is the time to start preparing for the next big trade as the markets move from one extreme toward another.

Open Text Corporation

(

OTEX |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 17.32

I’m including three high Short Term PowerRatings stocks that have yet to be tugged higher by the general mood of bullishness that prevailed on Tuesday. These are among the stocks that short term traders should be looking at when it comes to potential long trading strategies to the upside.

Scots Miracle Gro

(

SMG |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 37.99

We are also starting to see potential opportunities in short ETFs — an area that has helped provide excellent trading opportunities as markets became overextended to the upside. Right now, there are a few newly oversold short ETFs, but based on their relatively neutral Short Term PowerRatings of 5 and 6, it looks as if we are at least a day away from any real trading opportunities in those funds.

New Jersey Resources Corporation

(

NJR |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 26.19

So once again the trading strategy for PowerRatings traders is the waiting game. Stocks will either continue to rally, creating overbought conditions that we can take advantage of through high PowerRating short ETFs. Or stocks will pullback, creating oversold conditions that will allow us to consider select stocks that are down, and down significantly, but have not yet closed below their 200-day moving average.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.