TradingMarkets 3 Commodity ETFs for Traders: USO, SKF, GDX

Soon, TradingMarkets will be bringing you even more information and analysis on the exchange-traded funds that traders are using to take advantage of unique sector, industry group and international region opportunities. For now, consider these three commodity ETFs as part of a sneak peak.

The only thing hotter than investing in exchange-traded funds may be trading them. Whether it is by way of commodity-based exchange traded funds such as the ProShares UltraShort Financials ETF

(

SKF |

Quote |

Chart |

News |

PowerRating) featured here or other ETFs such as the Powershares DB Agricultural Fund

(

DBA |

Quote |

Chart |

News |

PowerRating), or simply by using leveraged ETFs to trade markets like the Dow industrials and Nasdaq 100, traders increasingly have turned to exchange-traded funds as a way of avoiding the perils of single stock trading.

Trading exchange-traded funds tends to be a less volatile affair than trading stocks, due largely to way ETFs are put together. While this can make for smoother price movement–assuming liquidity is strong and consistent, another issue with some lesser traded exchange-traded funds–it also often means that traders need to either (a) take bigger positions or (b) increase the duration of their trades in order to get the same sort of results that they might have been accustomed to when trading stocks.

The use of leveraged funds has been one major solution to this problem for many traders. By using leveraged ETFs, traders can use the same sorts of trading strategies–buying breakouts, buying pullbacks or buying swings–that they used when trading stocks but, because of the leverage involved, are likely to realize greater returns more competitive with those from stock trades.

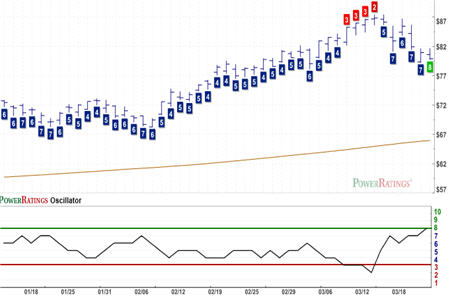

Let’s take a look at the three exchange-traded funds in today’s report. All of these exchange-traded funds have Short Term PowerRatings of 8. Based on our research, involving millions of short-term stock trades between 1995 and 2007, we learned that stocks with Short Term PowerRatings of 8 outperformed the average stock by a margin of more than 8 to 1. This, in our opinion, represents a significant edge over traders looking for upside in the average stock.

United States Oil Fund

(

USO |

Quote |

Chart |

News |

PowerRating) is an exchange-traded fund that seeks to mirror the price performance of West Texas light, sweet intermediate crude oil. This fund is neither diversified nor hedged, investing in futures contracts for West Texas light, sweet, intermediate crude oil as well as other forms of crude oil, heating oil, natural gas, and gasoline.

ProShares UltraShort Financials

(

SKF |

Quote |

Chart |

News |

PowerRating) is a leveraged exchange-traded fund that seeks to mimic twice the inverse of the performance of the Dow Jones U.S. Financial Index. That index consists of such well-known financial companies as Bank of America

(

BAC |

Quote |

Chart |

News |

PowerRating), Citigroup

(

C |

Quote |

Chart |

News |

PowerRating), and JP Morgan

(

JPM |

Quote |

Chart |

News |

PowerRating). The ProShares UltraShort Financials ETF invests 80% in financial instruments with characteristics that should produce results inverse to those of the Dow Jones U.S. Financial Index.

Last but not least is the Market Vectors Gold Miners ETF

(

GDX |

Quote |

Chart |

News |

PowerRating). This exchange-traded fund is designed to emulate the performance of the AMEX Gold Miners Index. The Market Vector Gold Miners ETF includes all the stocks that are components of the AMEX Gold Miners Index, maintaining the weighting of that index, as well. Some of the larger holdings of the fund include Barrick Gold

(

ABX |

Quote |

Chart |

News |

PowerRating), Newmont Mining

(

NEM |

Quote |

Chart |

News |

PowerRating), and Goldcorp

(

GG |

Quote |

Chart |

News |

PowerRating).

There are five things that every successful short term stock trader knows about trading markets like these. We have published all five in a new, special report called “5 Secrets to Short Term Stock Trading Success” now available for free. Learn what key factors are involved in turning mediocre speculators into professional-grade, short-term stock traders–and how our Short Term PowerRatings can play a part. Click here for your free report–or call us today at 888-484-8220.

David Penn is Senior Editor at TradingMarkets.com.